2020 Retail Seafood Review: Sustainability Remains Key Concern

Even as demand rises for plant-based proteins, consumers haven’t lost their taste for seafood. In fact, they plan to eat even more of it.

According to Chicago-based Nielsen’s 2019 “Protein Proliferation” report, 19% of consumers surveyed said that they intended to increase their consumption of meat and seafood — more than any other protein group. Meanwhile, fish and seafood dollars and units rose 8.7% and 2.7%, respectively, from 2017 to 2019, outpacing the growth of other proteins, including legumes, nuts and seeds.

“There have been numerous reports showing seafood consumption is on the rise,” agrees Megan Rider, domestic marketing director at the Juneau-based Alaska Seafood Marketing Institute (ASMI), citing Chicago-based Mintel’s “Fish and Shellfish — US, November 2018” report, which found that “seafood consumption is up 13% over the last five years and is expected to continue to grow an additional 15% over the next five.”

What more, adds Rider, “the same Mintel report predicts the frozen segment to grow the fastest over the next five years. Frozen items (across various food groups) are experiencing a revival as consumer perception shifts towards viewing frozen foods as equally nutritious [as] their fresh counterparts.”

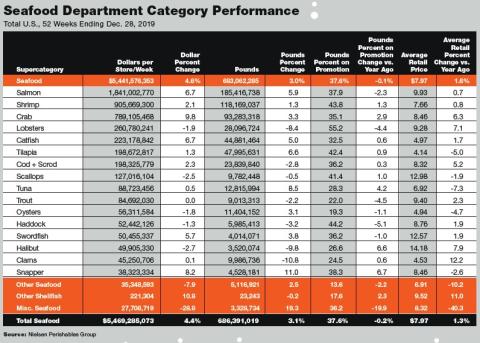

All of this adds up to a solid performance over the past year. “Seafood … posted strong growth in dollars and in pounds as an entire department, [up] 4.4% and 3.1%, respectively,” affirms Meagan Nelson, associate director at Nielsen.

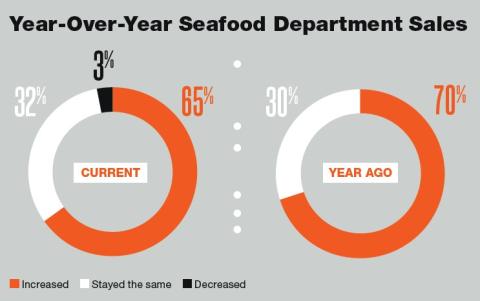

Progressive Grocer’s annual exclusive Retail Seafood Review survey, which gauges the observations of retail executives — 77% of whom have service seafood sections in their stores, accounting for about 7.8% of total sales — similarly finds consumer interest in seafood still strong: 65% of respondents say that sales of the category have increased over the past 12 months, down from last year’s 70%, while 32% say that they’ve held steady, and 3% say that they’ve declined. On average, sales rose 7.6%.

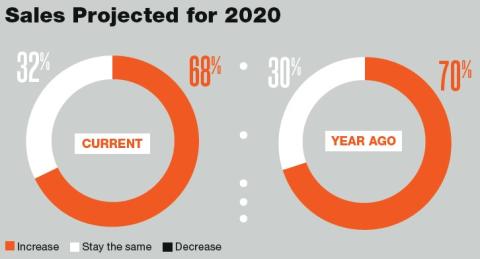

Projecting ahead, 68% of respondents think that seafood sales will rise — slightly down from 70% in 2019 — and 32% think that they’ll stay the same, with no one predicting a sales decrease. On average, respondents forecasted sales growth of 5.4%.

“We had a strong growth year in 2019, driven largely by shrimp, crab and lobster sales,” asserts Maria Brous, spokeswoman for Lakeland, Fla.-based Publix Super Markets.

The company expects some challenges in the year to come, however, thanks to a recent outbreak of illness. “China is a major driver in the global market, and with the coronavirus, we are seeing demand from China decline,” explains Brous. “This has resulted in some unexpected price drops, and price is a major component [in] seafood performance.”

“Our seafood sales were above expectations simply due to concentrating this past year on quality,” says Justin Glover, VP perishables-store manager at the Perryville, Ohio, location of two-store independent grocer Walt Churchill’s Market. “We beat numbers over years past easily, due to stepping back to be sure our quality matched our price.”

Glover foresees higher sales in the coming year, as the company is already “exceeding sales from last year,” due to the fact that it’s “concentrating more on quality products over quantity.”

Sustainability’s Staying Power

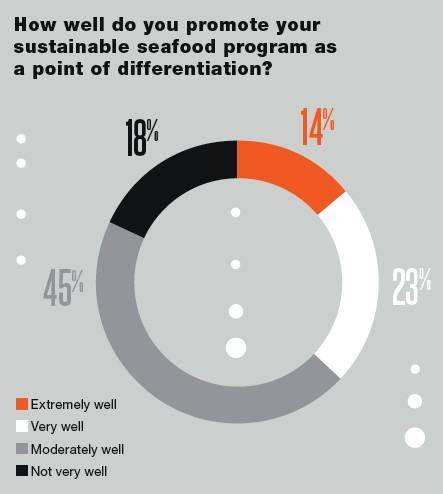

Sustainability remains a major selling point in the seafood section, although perhaps not one being leveraged to its fullest potential.

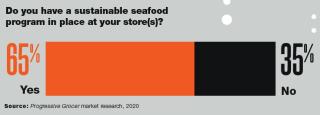

According to PG’s survey, 65% of respondents have a sustainable seafood program in place at their stores, and of those, 14% believe that they promote these programs extremely well and 23% think they do so very well. The 45% who say that they promote their programs only moderately well and the 18% who admit to not promoting their sustainable seafood very well at all leave room for improvement in this area, however.

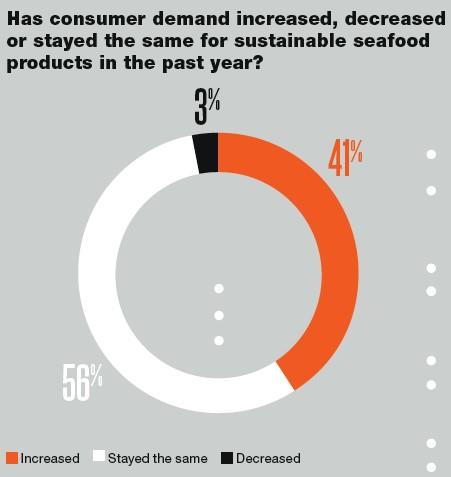

Shoppers continue to purchase sustainable products in solid numbers, with 41% of respondents noting an increase in demand for them and 56% reporting no change in demand.

Savvy grocers and their partners have been responding to that demand.

“Lidl is unique in the market to require that all listed fresh and frozen seafood is certified sustainable or responsibly farmed,” notes Chandler Ebeier, spokeswoman for the Arlington, Va.-based deep-discount grocer. “Partnering with highly regarded certifying organizations like the Marine Stewardship Council ensures that customers have a simple, straightforward choice when it comes to their seafood. Our industry-leading commitment, coupled with Lidl’s industry-leading prices, makes Lidl an easy choice for seafood and is another way we make healthy eating more attainable across our markets.”

“ASMI works with retailers to tell the story behind the seafood they sell, including highlighting origin, quality and sustainability as differentiators that make seafood from Alaska some of the best in the world,” says Rider.

“Sustainability is a big consumer concern when buying seafood,” affirms Iréne Moon, VP of marketing at Portland, Maine-based supplier Bristol Seafood. “When they walk into the store, they already trust that the grocer has done their diligence. The best thing for the grocer is to talk about sustainability before the shopper decides where to buy seafood.”

Offering sustainable products offers an additional advantage to food retailers.

“Not only are consumers placing importance on sustainable seafood practices, they are willing to pay more for food that was produced sustainably or is perceived to be higher quality,” points out Rider, citing a 2019 study from Arlington, Va.-based FMI — The Food Industry Association, “The Power of Seafood.”

Fish-Free Fish

Much has been made lately of plant-based meat alternatives jostling for supermarket space with their animal protein counterparts, but piscine equivalents are flowing into the market as well, including Good Catch’s shelf-stable and frozen vegan seafood SKUs and Atlantic Natural Foods’ Loma Linda Tuno plant-based canned and pouched tuna, in addition to new items in this space reportedly due from plant-based meat makers Prime Roots and Impossible Foods, and even products being developed from cells in a lab, like the items recently demonstrated by San Diego-based BlueNalu.

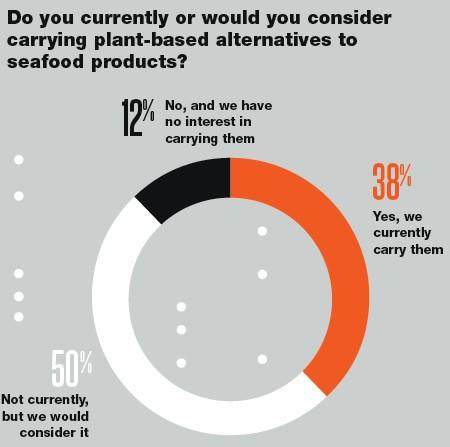

Among the respondents to PG’s survey, 38% already carry plant-based seafood alternatives, while 50% say they don’t but would consider it. Just 12% don’t carry such items and have no interest in doing so.

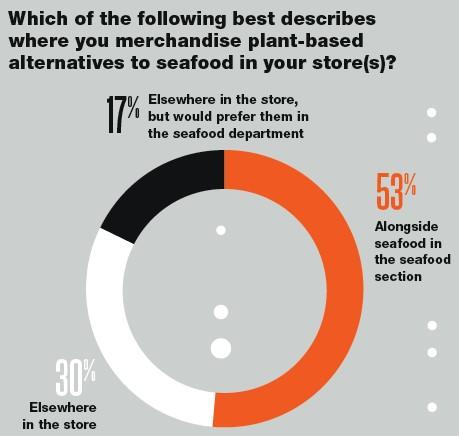

Out of those that already carry plant-based seafood alternatives, a solid 53% merchandise them right alongside seafood products, while another 17% offer them elsewhere in the store but would prefer to merchandise them in the seafood section. Thirty percent carry them elsewhere in the store, with no plans to place them next to seafood items.

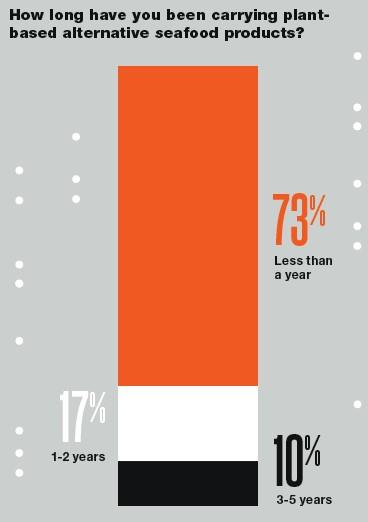

Reflecting the relative newness of this trend, 73% of respondents that offer plant-based seafood alternatives note that they’ve been doing so for less than a year, while 17% have offered them for one to two years and 10% have provided them for three to five years.

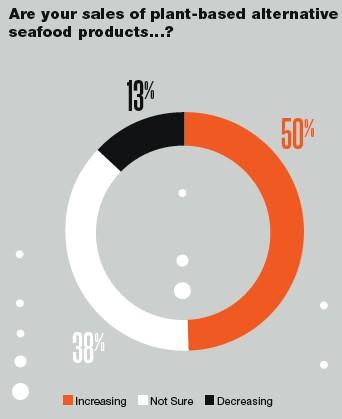

When asked how these plant-based products are faring, although it was too soon to tell for 38% of respondents, 50% say that their sales in this area are rising, while only 13% report that they’re on the wane.

The plant-based seafood trend is still trickling its way into stores across the country. Walt Churchill’s Glover hasn’t personally experienced demand for plant-based seafood yet, while Publix’s Brous points out: “There is very limited demand for plant-based seafood at this time, as it is fairly new to market. We offer plant-based options at our GreenWise Market stores.”

There, she adds, “Plant-based seafood is merchandised in the seafood department. Research and testing indicate that this consumer is a flexitarian. We wanted to provide adjacency to make shopping more convenient for our customer.”

Regardless of where the plant-based segment is merchandised, Moon counsels that it should be “clear that it is a plant-based alternative to seafood, so the shopper knows what they are purchasing. Transparency and honesty from a brand are extremely important to U.S. consumers.”

Rider, of ASMI, agrees with clear labeling for plant-based alternatives, giving as a reason that “many health benefits and key nutrients of wild, sustainable Alaska seafood, for example omega-3 fatty acids DHA and EPA, can’t be easily replaced by plant-based options.”

Popular Products and Promotions

Which seafood items are consumers buying most? Respondents to the survey pinpointed U.S. wild-caught seafood, which 68% say has seen an increase in consumer demand over the past year, followed by imported wild-caught seafood, which 50% note has experienced higher demand, and farm-raised seafood, which 30% describe as being more in demand.

Regarding particular species, Nielsen’s Nelson observes: “Salmon, crab, catfish, tilapia and tuna all outpaced the department pounds growth; of those, only tilapia did not see dollars grow as pricing fell. Lobsters, cod/scrod, scallops and trout were the top-selling species that saw declines in volumes in 2019.”

“Salmon, shrimp and crab are best-sellers due to the customer’s familiarity with the seafood,” notes Brous, while Glover observes that “Atlantic farm-raised salmon carries the sales” at Walt Churchill’s Market. “This is a Foley Fish branded product that is always consistent, and our customers love it.”

Convenience also plays a key role in shoppers’ choices. For instance, Bristol Seafood’s best-selling retail item is the frozen value-added ready-to-cook My Fish Dish line encompassing scallops, cod, and Atlantic and Sockeye salmon, which, Moon explains, “has simple 1-2-3 cooking instructions and gives [consumers] the confidence they can cook it at home.”

In the realm of seafood promotions, Brous is direct in her advice: “Consistently merchandise the highest-quality seafood that offers a value to the consumer.”

“We run a wide array of promotions to help drive awareness and sales of wild seafood at key moments throughout the year,” notes David Sanz, meat and seafood merchandiser at Seattle-based PCC Community Markets. “We have seen the most success when our programs align with the seasonality of seafood through a fully integrated promotional campaign including in-store signage, social/digital promotion and in-home marketing efforts. For example, timed with the wild Alaska salmon season, we ran a robust program that included in-store display signage, recipe features across our owned social channels, and direct-marketing BOGO offers, which led to a significant increase in sales during the summer.”

“So far this year, we have been advertising double points with our loyalty card on select fish,” says Glover. “Last month was on hake filets from Foley, and we almost doubled sales in hake that we would not have had before. [In February, we did] a local walleye. … So far, sales seem to be on the upswing.”

“Larger-scale promotions can … grow sales substantially,” observes ASMI’s Rider. “One of our retailer partners, Hy-Vee, recently conducted a significant promotional push around wild Alaska crab season in its stores. For their annual month-long crab promotion, Hy-Vee utilized television, print ads, digital channels, and coordinated in-store sampling by dietitians and chefs to create excitement and inspiration. Ahead of the promotion, Hy-Vee trained its employees to ensure they had the knowledge to instill purchase confidence in customers, share preparation tips and help shoppers differentiate between the various species of wild Alaska crab that were included in the promotion.”

For her part, Bristol Seafood’s Moon simply notes, “Merchandising the product off-shelf, together with an ad in the retailer’s flier, delivers the highest rate of sale.”