Category Spotlight: Beverages

Convenience is key when it comes to increasing beverage sales today. Bottled water is up 7.7 percent from a year ago, energy drinks are up 11.2 percent, and ready-to-drink (RTD) coffee and tea are up 3.7 percent, according to IRI.

There’s likely no surprise regarding these increasing numbers in today’s always-on-the-go world, but some of the big players may be illuminating.

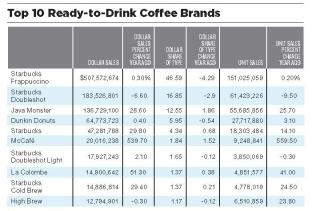

The largest coffee chain in the world, Starbucks, has five of the top 10 RTD cappuccinos or iced coffees, and these five individual Starbucks brands accounted for more than $770 million in sales in the past year.

Coca-Cola has three RTD coffees in the top 10; one is through its partnership with Dunkin Donuts, a second through McCafé and a third as a distributor for Java Monster, produced by Monster Energy. Coca-Cola is a company to watch in the category, as it acquired coffee company Costa earlier this year for $4.9 billion and has already launched three RTD products in Great Britain, with plans to expand rapidly.

Coffee is a $14.4 billion market, and of that, RTD is the fastest-growing segment, rising 31 percent in the past two years, according to the July 2018 “Coffee - US” report from market research firm Mintel.

RTD is also the fastest-growing segment of the tea market, as well as the only segment growing in both volume and value, according to Beverage Marketing Corp.

Lipton continues to be one of the top players, with four of the top 10 brands of RTD canned and bottled tea in the past year. Coca-Cola has a strong showing in this category as well, with Gold Peak sales increasing 3.7 percent. Arizona and Snapple each individually have two brands in the top 10, while Monster Rehab rounds out the rankings, although its sales have dipped 2.6 percent in the past year.

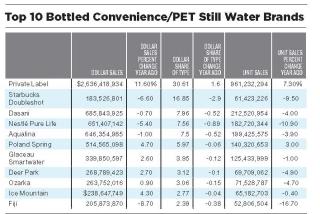

Bottled water is still the top-selling beverage category in the United States, with its sales continuing to increase — 5.8 percent for bottled still water and a huge 15 percent for bottled seltzer/sparkling/mineral water in the past year. In both of these categories, private label brands lead the charge.

Private label still water sales increased 11.6 percent over the past year, with all other brands in the top 10 increasing less than 5 percent, and quite a few of the brands actually seeing decreases in sales.

The brands seeing the highest increases in sales, after private label, were Poland Spring and Ice Mountain. Fiji, marketed as artesian water, saw sales decrease a huge 8.7 percent, while Nestlé Pure Life saw a decline of 5.4 percent.

As consumers continue to search for grab-and-go options in the food aisles of grocery stores, it only makes sense that they’re looking for bottled RTD refreshments as well. These large sales increases for RTD coffee and tea, as well as for bottled water, don’t exist in a vacuum, though; they’re accompanied by decreases in conventional beverages — coffee, tea and even tap water — across the categories.

DISCOVER THE 2019 DATA

IN-DEPTH ANALYSIS

Read our in-depth analysis of some of the other categories in this year's study, including: