COVID Buyer Habit Index Quantifies Stickiness of New Consumer Behaviors

The COVID-19 pandemic has greatly affected at-home food consumption and food delivery, but as vaccines become more readily available to the general public, retailers are wondering what, if any, of the pandemic buying behaviors are likely to remain in the public’s post-COVID routines.

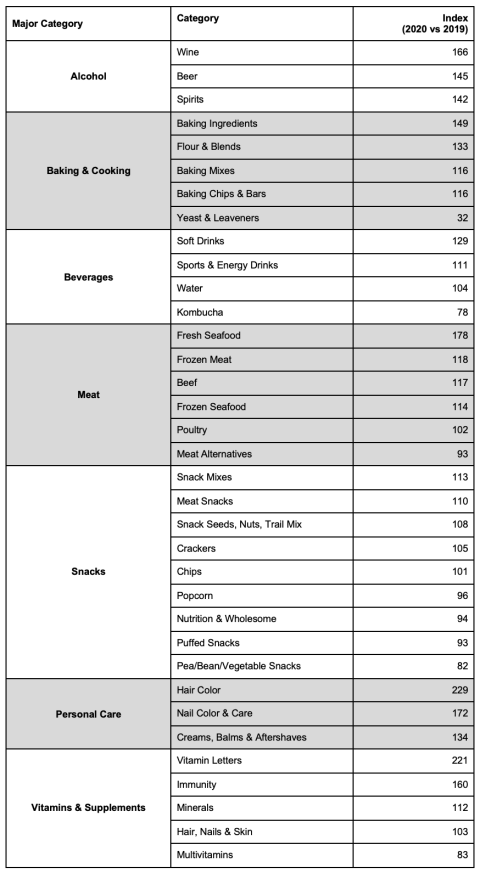

As a result, Numerator, a data and tech company serving the market research space, has launched a COVID Buyer Habit Index to understand the "stickiness" of new consumer buying behaviors formed during COVID-19. The analysis examines seven major fast-moving consumer packaged goods (FMCG) categories (alcohol, baking and cooking, beverages, meat, snacks, personal care, and vitamins and supplements) to identify which categories were more habit-forming in 2020 versus 2019.

"Consumers radically changed buying behaviors during COVID. Brands and retailers need to understand which new COVID behaviors solidified into habits that are likely to persist post-COVID," said Eric Belcher, CEO of Chicago-based Numerator. "This is important to define reopening strategies, from marketing through inventory management."

The index compares repeat purchase behavior of new category buyers during the height of COVID-19 panic buying (March-April 2020) to new buyers in the same period in 2019. Numerator used six repeat purchases by year-end 2020, following a first-time purchase in March-April 2020 to qualify as habits, although the study can be adjusted for any time period and repurchase rate.

New buyers are defined as having purchased a given product/category for the first time in six-plus months during the focus period of March-April 2020. New habit formers are a subset of new buyers, and have repurchased the category in six or more of the remaining months in the post period (May-December 2020). The New Habit Index is calculated as the percentage of new buyers who formed habits in 2020 versus the percentage who formed habits during 2019.

Numerator found that extensive time at home has helped consumers master more complex and less familiar food preparation (e.g., raw baking ingredients indexed higher than baking mixes; fresh seafood indexed higher than more familiar meats and poultry). Key category findings include:

Alcohol

- New alcohol buyers were more likely to have continued to buy alcohol throughout 2020 than new alcohol buyers in 2019, boosted by widespread bar and restaurant closures.

- Wine was the most sticky alcohol category, with 2020 new buyers 66% more likely to have repurchased the category in six or more of the remaining months of the year (versus 2019), followed by beer (45%) and spirits (42%).

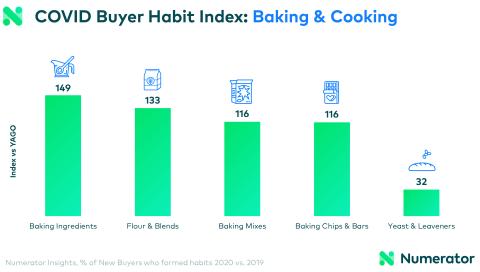

Baking and Cooking

- Baking from scratch became a habit: Raw baking materials were far more likely to be sticky in 2020, with baking ingredients and flours and blends indexing at 149 and 133, respectively, versus baking mixes at 116. One notable exception was yeast and leaveners, which indexed at 32.

Beverages

- New soft drink buyers were 29% more likely to have formed a habit versus 2019 new buyers, with a COVID-driven shift from out-of-home to in-home consumption.

- The sports and energy drink Habit Index was 111. Kombucha was less habit- forming in 2020 versus the prior year, with new drinkers 22% less likely to have formed a habit.

Meat

- Seafood was more habit-forming in 2020 than in years past, with fresh seafood indexing at 178 and new frozen seafood at 114.

- Beef and frozen meat new buyers were more likely to have formed a habit during the pandemic as well, with 2020 buyers 18% and 17% more likely to have formed a habit, respectively, in 2020 versus 2019.

- Despite gaining traction in the past few years, meat alternatives new buyers were slightly less likely (-7%) to have formed a habit in 2020 versus 2019.

Snacks

- Snack mixes and meat snacks were slightly more likely to be habit-forming in 2020, at 13% and 10%, respectively.

- Healthier snacks were slightly less likely to be habit-forming (popcorn, -4%; nutrition and wholesome, -6%; puffed snacks, -7%; pea/bean/vegetable snacks, -18%).

Personal Care

- In certain personal care categories, consumers appear to have adapted to self-service, opening the door to lasting habits. New hair color buyers were far more likely (129%) to have stayed in the category, along with new nail color buyers (72%).

Vitamins and Supplements

- Vitamin letter (121%) and immunity (60%) supplements led the way as consumers looked for ways to stay healthy throughout the pandemic.

COVID Buying Habit Index

(March/April 2020 new category buyers versus year-ago new category buyers)