Family Dollar Enters 1st Phase of Enterprise-Wide Digital Transformation

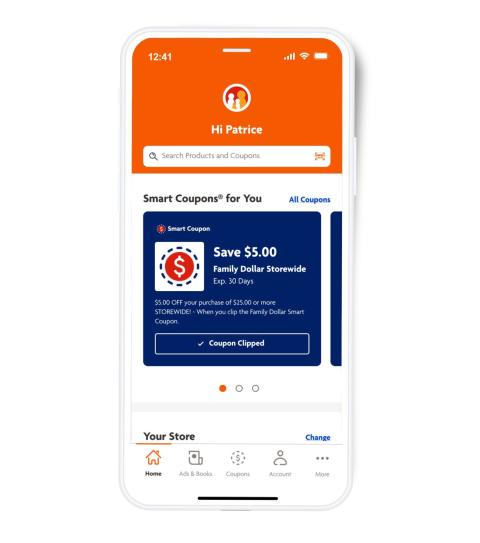

Shoppers will soon be able to do more with the new Family Dollar mobile app that hits app store shelves in October. A step in the banner’s digital transformation, the new Family Dollar app will help shoppers manage coupons using the redesigned wallet feature, explore engaging weekly ads and easily locate products with intelligent searches.

According toChaseDesign’s 2023 Dollar Store Channel Survey, the digital experience of dollar stores is seen as less central to the shopping experience. The survey found that a majority of shoppers never even use dollar store retailer shopping apps, nor do they order products online, which is quite different from the mainstream grocery and mass channels.

“At Family Dollar, we wake up every day focused on how we can help our shoppers do more and save more, and this app is one more way we’ll be able to deliver on that promise,” said Emily Turner, chief marketing officer at parent company Dollar Tree. “We believe this new user experience will not only appeal to our customers, but to brands who want to promote their products to our millions of customers through Chesapeake Media Group, our retail media network.”

“We are investing across the enterprise to make shopping with us even easier and more enjoyable,” added Bobby Aflatooni, CIO at Dollar Tree. “The redesigned Family Dollar app reflects the customer-centric approach we’ve applied to our digital roadmap to improve the shopping experience for our loyal shoppers and new customers alike.”

Future phases of the digital transformation include Family Dollar app features in early 2024 like in-app e-commerce, personalization capabilities and an evolved rewards experience, as well as a Dollar Tree mobile experience customers are seeking, the company said.

Digital consultancy Publicis Sapient was selected to lead the program, enabling Family Dollar to offer a premier mobile experience platform. “We are proud to support Family Dollar in the launch of its new mobile experience using our core capabilities (Strategy, Product, Experience, Engineering, and Data & AI),” said Sudip Mazumder, SVP, retail industry lead, North America at Boston-based Publicis Sapient. “The work is designed to offer exceptional usability and a best-in-class customer experience.”

Meanwhile, Dollar Tree reported a year-over-year (YoY) decline in earnings for its second quarter ended July 29. The company’s operating income dropped 43.1% YoY, amounting to $287.7 million. A decline in gross margins follows the prior year’s margin benefit stemming from the 2022 move to a $1.25 price point at Dollar Tree.

Although the Q2 earnings slide was notable, the decrease was less steep than many Wall Street analysts had anticipated. In an earnings call, Executive Chairman and CEO Rick Dreiling also put the Q2 performance into context, noting that consolidated net sales rose 8.2%, enterprise same- store sales increased 6.9% and store visits were up 3% at Family Dollar and 10% at Dollar Tree.

Chesapeake, Va.-based Dollar Tree has 16,476 stores across 48 states and five Canadian provinces as of July 29. Stores operate under the brands of Dollar Tree, Family Dollar and Dollar Tree Canada. The company is No. 21 on The PG 100, Progressive Grocer’s 2023 list of the top food and consumables retailers in North America.