Food Inflation Still High, But Signs Point to Cooling

Amidst a barrage of news about high egg prices, new government data indicates that food inflation may finally be cooling. The latest Consumer Price Index (CPI) data from the U.S. Bureau of Labor Statistics (BLS) showed the CPI for food at home rose 0.2% in December, the lowest monthly rate hike since March 2021.

The overall inflation rate actually fell last month, down 0.1%. The drop – seemingly small but the largest since the COVID-19 lockdown month of April 2020 – was primarily attributed to declining fuel prices. The price of gasoline fell 9.4% in December.

Although the CPI slowdown for food at home is welcome news, prices remain comparatively elevated. Food-at-home prices are still 11.8% higher on a year-over-year basis, according to BLS. Other recent data affirms that 2022 was a year marked by inflation: Market intelligence firm Datasembly recently published a year-end update showing that the cost of groceries spiked 16.3% in the calendar year, versus 6.2% in 2021 and 1.1% in 2020.

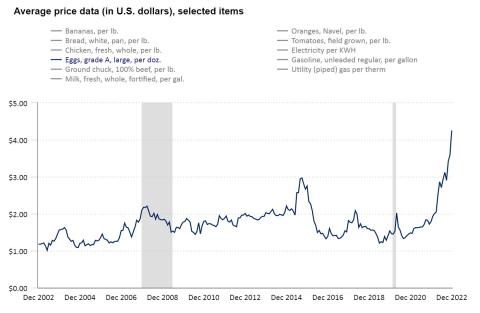

Within the food-at-home sector, three of the six major grocery food group indexes increased in December. The CPI for animal proteins, spanning meat, poultry, fish and eggs, went up 1% for the month. Eggs as a category remained stubbornly high with a CPI hike of 11.1%, due to concurrent ongoing issues with supplies and feed and fuel costs. Nonalcoholic beverages ticked a slight 0.1% higher.

The CPI went into negative territory for dairy and related products, which dipped 0.3% last month. The CPI for cereals and bakery products was unchanged.

As for food away from home, the CPI edged up 0.4% in December, down a bit from the 0.5% foodservice increase in the previous month. The total food industry, then, saw a 0.3% CPI lift for the holiday-centric month.

The BLS data for December is generally in line with analyst expectations. Following the report, all eyes are on the Fed and its stance on interest rates, as many market experts anticipate another 0.25% bump in early February.

As prices slowed but remain elevated in December, wages are moving ahead. Earlier in January, BLS reported that real average hourly earnings for all employees rose 0.4% from November to December, with wages up 4.6% compared to a year ago.

Government data released this month also revealed that the overall unemployment rate went down to 3.5% last month and that new grocery jobs comprised more than half of the 9,000 retail trade jobs added in December.