Food Retailers Missing Out on Billions in Alcohol Ecommerce Sales

According to a report from global food and agribusiness bank Rabobank, food retailers and alcohol brands miss out on billions in online sales opportunities annually, even as alcohol ecommerce sales in the United States hit $2.6 billion last year.

“If they only look at current sales, industry executives will severely underestimate the value of their ecommerce opportunity,” noted Bourcard Nesin, a beverage analyst at Rabobank and author of the “2020 Alcohol Ecommerce Playbook” report. “There is no doubt consumers will move their beverage spending online. The question is whether beverage companies and retailers have the vision to invest proactively in their ecommerce capabilities.”

Nesin’s report contended that industry leaders must consider the value of missed sales opportunities, the future importance of online shopping for younger generations entering their prime spending years and how online experiences shape in-store consumer behavior.

The report categorized alcohol ecommerce in four channels, each with its own particular challenges and opportunities, including online grocery, encompassing supermarkets and other general food and beverage retailers that offer online alcohol sales. In this channel, sales reached $295 million, rising 115% year-over-year in 2019.

Although supermarkets are currently the largest channel for alcohol sales, with more than 10% of all grocery anticipated to shift online over the next four years, grocers lacking an alcohol ecommerce strategy will miss out on $3.7 billion in alcohol sales by 2023, according to the report.

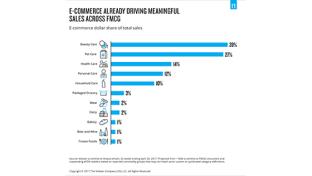

Also noted in the report was that alcohol is the fastest-growing category in grocery, but that its share of online sales is almost 90% lower than its share of in-store sales. Higher alcohol sales can be a boon to major grocery store chains under pressure to increase their overall online grocery sales.

Another channel covered by the report, DTC (direct to consumer) wine online, in which wine sales are processed through a winery website and shipped directly to the consumer without the involvement of a distributor, saw sales of $950 million, having increased by at least 9% last year.

As Zac Brandenberg, co-founder and CEO of Los Angeles-based DRINKS, a digital wine technology platform that enables retailers to market wine for delivery around the United States, wrote last year on progressivegrocer.com, “Early-adopting grocers that take advantage of this market opportunity with a robust DTC wine program will reap sizable rewards by monetizing their existing customer bases and expand their reach beyond their physical store footprint.”

To make the most of sales opportunities, companies should offer a seamless online buying process for consumers, the report advised, adding that many ecommerce teams lack the resources to provide enough content and adequate product information for the myriad websites and online sales platforms available.

“Consumers are rapidly moving their food and beverage spending online, creating new shopping habits and brand relationships in the digital world,” said Nesin. “If the alcohol industry does not act quickly, their brands will be left out of this important relationship-building process. Ecommerce, rather than a source for growth, could then become a wedge separating alcohol brands from their consumers.”