Grocers Capitalize on The New Meat Revolution

Everyone knows that the U.S. consumer’s hunger for meat is changing.

Americans are switching up their protein game as they worry about the health implications of eating meat — not just their own health, but also the health of the planet. A 2018 Oxford University study contends that the most effective way for humans to reduce their environmental impact is to avoid meat and dairy.

Key Takeaways

- Globally inspired marinades paired with an app offering cooking directions make for a winning combination.

- Offer more exclusive cuts with easy prep instructions, as in meal kits.

- Don’t forget that shoppers are scrutinizing every ingredient on labels.

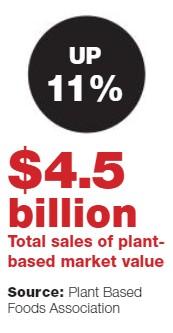

To wit, sales of meat substitutes and plant-based products are soaring. U.S. retail sales of plant-based foods have grown 11% in the past year, bringing the total plant-based market value to $4.5 billion, according to the Washington, D.C.-based Plant Based Foods Association. Burger King’s Impossible Foods brand vegan Whopper is selling like hotcakes, and Impossible Foods’ main plant-based rival, Beyond Meat, saw its stock value soar an impressive 163% on its Wall Street debut in the best IPO of 2019 so far — valuing the company at $3.77 billion.

Buying and eating trends suggest a rise in “flexitarianism” among traditional meat eaters who show a willingness to stray for reasons nutritional or environmental.

So, as consumers yearn for more nontraditional meat options, grocers are rushing to meet that demand with alternative products. Retailers and manufacturers are seeing a rapid transformation in how consumers eat meat as technology and sustainability collide. The Kroger Co., for example, is piloting a dedicated plant-based protein section in its refrigerated meat case. Sixty of the Cincinnati-based grocer’s locations in parts of Indiana and Illinois, as well as in Denver, will run the test for 20 weeks.

While there’s no doubt that consumers are looking for alternatives and innovation when it comes to sources of protein, much of that desire for innovation and alternatives frankly has nothing to do with veganism and everything to do with convenience.

Yes, there is change unfolding in the grocery meat department, but it’s not all plant-based.

“I think we are on the cusp of a revolution in the meat case,” says Kent Harrison, VP of marketing and premium programs at Dakota Dunes, S.D.-based Tyson Fresh Meats. “If you look at our demographics and the populace, you have a Baby Boomer population that is aging out of high-quantity meat consumption. Then you have the Gen Xers, the Millennials and Gen Z, who all have different appetites for meat products. And the younger generations have less knowledge of what to do with different meat products. So, over the next five years, these demographics will combine with the dearth of people who know how to properly run a meat department at retail. I think all those factors together, plus other consumer demand factors, will lead to this revolution.”

Which “other consumer demand factors?” A visit to the meat department at a Publix supermarket in Florida reveals the answer.

Laotian Larb, Anyone?

On a recent Saturday afternoon, shoppers in the meat department of a Publix store in Tampa, Fla., could be seen grabbing packages of Thai Style Ground Chicken — ground chicken thigh meat marinated with garlic, shallots and ginger — placed right next to the conventional ground chuck beef.

According to the label, the ground-chicken product is designed to be used to make a Thai nam sod or Laotian larb. Both are appetizers of ground meat spiked with chiles, lime juice and fish sauce, and are usually served wrapped in lettuce leaves.

A look around the rest of the meat department showed value-added meats accounting for nearly half of all products in the refrigerated meat section. Shoppers inspected Cuban mojo-marinated chicken breasts, yakitori-flavored chicken skewers and even bourbon-spiced salmon — all pre-cut, accessorized with vegetables and prepped for the grill. Plastic-wrapped packages of fajita-spiced beef chunks sat beside meal kits full of shrimp seasoned and ready for pasta.

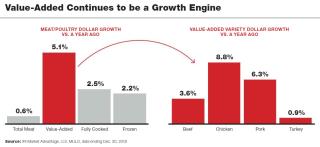

The growth in marinated and other value-added meats is a reflection of the American consumer’s never-ending quest for convenience, an interest that may trump the sales growth of plant-based or clean-label foods. At $4.6 billion, sales of value-added meat and poultry that provide shortcuts of some kind have risen 5% over the past year, exceeding total category performance, according to the Food Marketing Institute’s (FMI) 2019 “Power of Meat” report.

“We look at the value-added category as something that is evolving rapidly and growing rapidly to the point where it will be a focus for us over the next five years,” Tyson’s Harrison says. “Meat consumers want new and interesting marinades, extended shelf-life packaging, net-weight products with smaller portions cut to the exact size that they like. These are the things that are going to lead us to a dramatically different meat case.”

Hold the Plants

While it’s true that consumers are craving more alternatives to meat, the idea that the U.S. population is moving to a plant-based diet is more than extreme — it’s just plain wrong.

Americans still love their animal-based protein: According to the 2019 “Power of Meat" report, 86% of shoppers reported that they still eat traditional meat. In this $67 billion category with a household penetration of 98.9%, two-thirds of shoppers mainly prepare fresh meat and poultry.

Consumers continue to choose fresh meat, poultry and seafood as their preferred sources of protein, which are still tops when it comes to dietary trends. Eighty-one percent of Millennials, 74% of Gen Xers, 66% of Baby Boomers and 50% of Silents said that protein content is extremely or very influential when making grocery store purchases, according to the 2018 “Progressing Protein Palates” report from Jacksonville, Fla.-based consumer packaged goods marketing agency Acosta.

The percentage of vegans and vegetarians has remained steady at 5% to 7% since 2017, according to consumer data presented by Randy Blach, CEO of Centennial, Colo.-based market tracker CattleFax, at the recent Certified Angus Beef annual brand conference. Blach added that the USDA expects U.S. per capita red meat and poultry consumption to hit a new record high in 2020.

In fact, the popularity of animal-based protein and protein-heavy diets such as keto and Paleo are prompting many grocers, including Lakeland, Fla.-based Publix Super Markets, to up their value-added meat game. Accordingly, value-added meats have emerged as a strong growth area for grocers in recent years.

“The never-ending quest for convenience exemplifies the lifestyle-driven nature of meat purchases,” notes Rick Stein, VP of fresh foods at Arlington, Va.-based FMI. “Sales of value-added meat and poultry that provide shortcuts of some kind have risen 5% over the past year. Arguably, the growth is influenced by two factors: convenience and confidence. Because the meat purchase is a planned purchase, and consumers are often unsure how to prepare and cook types of meat, value-added meats push consumers halfway to the goal line. Thanks to marinades, cooking instructions and basic prep work, grocers are helping to give their shoppers the confidence they need to prepare a delicious meat dish in a manageable amount of time.”

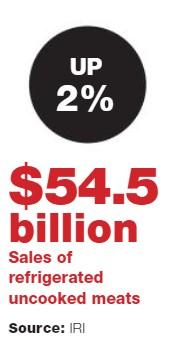

According to Chicago-based Information Resources Inc. (IRI), sales of refrigerated uncooked meats increased 2% during the 52-week period ended June 16, with sales reaching $54.5 billion. Beef sales were up 1.1% during the same period, to $25 billion. Sales of other meats, excluding beef, chicken, pork and turkey, were up 4%.

According to FMI’s Stein, the value-added meat and poultry categories can’t get enough attention from grocery retailers, especially since marinated/seasoned items have a higher margin compared with non-marinated proteins.

“In value-added or semi-prepared meats, where the product might come marinated or with recipes, or something like a prepared kebab, that is the fastest-growing segment in all of fresh, including produce, seafood, meat and poultry,” he says.

- There were better prices: 59%

- There was greater assortment/availability: 35%

- There was a greater variety of flavors: 32%

- There was insight into the quality used: 30%

- There was insight into the freshness used: 27%

IRI’s "State of Meat 2019" research revealed that 86% of shoppers could be prompted to buy more value-added meats if:

Another trend that food retailers should take into account as they go about how to merchandise value-added meat products is meal kits. In the past year, in-store meal kits overall have seen a 26% increase in sales, growing to $154.7 million in retail sales, according to Chicago-based Nielsen. These meal solutions, which run the gamut from ready-to-cook to partially cooked, can introduce shoppers to new types and cuts of value-added meats.

“There’s still a ton of different variations of meal kits, and people are looking for the right price point,” Harrison observes. “We found a couple that really work in our Tyson brand, where we have the raw-material meat, the prepackaged vegetables, the sauce that goes with it, and those have sold very well. But another area we’re looking at, not only for retailers, but in the extended version of home use for meal kits, is how can we be the protein providers in the right portions in the right sizes with the right flavors for those meals.”

Beyond the self-service meat case, he notes that even the full-service meat counter will undergo an evolution, with more value-added, case-ready and innovative items available.

“You see that already, more to the point where part of our value-added offering will end up being how can we provide products in a case-ready format that retailers can take out of, say, a vacuum-sealed mother bag and just slide right into a full-service case,” Harrison says.

Retailers are maximizing their case-ready assortments at a time when shoppers’ perception of case-ready meat has reached its highest favorability rating yet, according to IRI’s “State of Meat 2019” report. About 80% of shoppers believe that case-ready meat is as good as or better than meat that’s cut or packaged in-store.

In terms of which cuts to offer, “in beef, middle meats are driving most of the growth, and that’s your ribeyes and your most tender cuts of beef,” Stein points out. With a strong economy boosting consumer confidence, even higher-end cuts are seeing growth, including ribeye roast (14.2%), T-bone steak (13.9%) and bone-in strip steak (9.5%), according to the 2019 “Power of Meat” report.

Sea Changes

As for today’s seafood shoppers, a significant finding from FMI’s 2019 “Power of Seafood” report is that although the seafood sector is comparatively smaller than fresh meat and poultry, it’s nonetheless lucrative. Seafood shoppers have a higher average household income and education level, and choose to spend more money on groceries, and the average basket size nearly triples when these shoppers buy seafood, versus the baskets of non-seafood consumers, FMI found. Longtime favorites like shrimp, salmon and tuna are still king, representing a combined 60% of the market, according to the report.

As shoppers increasingly have more choices of where to buy their meats, grocers should try to deliver the kind of value-added assortment that competitors can’t match. Consumers will be looking for value-added innovation such as premium brands, exclusive cuts, easy prep solutions, clean labels and globally flavored marinades.

Retailers should also pay attention to trends such as combining animal- and plant-based proteins in the same product, or offering technology solutions that clearly communicate cooking instructions. Also, to drive even more sales in value-added meats, retailers and suppliers should work together to leverage food trends for the best possible assortment, service and shopping experience.

“Consumers are expecting greater focus on modern versions of value-added meat that go beyond simple pre-seasoning to offerings that provide heightened discovery, either global or regional seasonings, and prep methods, to pre-pack cuts that provide a deeper level of transparency regarding treatment of animals, workers and more natural processing,” says Melissa Abbott, VP of retainer services for The Hartman Group, in Bellevue, Wash. “We can anticipate increasing consumer interest in callouts that speak to grass-fed, hormone- and antibiotic-free, 5 Step Animal Welfare Rating, [and] Certified Humane Raised and Handled.”