Grocers, CPGs Celebrate Black History Month With New Collections, Campaigns

Throughout Black History Month, brands and grocers have spotlighted their efforts to provide more culturally and personally relevant products to Black consumers. While February is a month focusing on Black heritage, these efforts extend throughout the year and continue to build on a larger momentum.

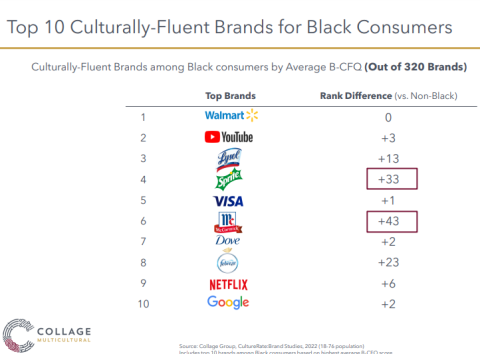

Some legacy brands are resonating particularly strongly with Black customers. Cultural intelligence firm Collage Group recently measured how brands have effectively used culture to connect across the Black segment and found that Lysol, Sprite, McCormick, Dove and Febreze are making strong inroads.

[Read more: "Rite Aid Commits $1M to EmbraceRace to Accelerate Racial Equity Initiatives"]

For example, Collage Group reported that McCormick’s campaign with partner chef Millie Peartree was successful because it acknowledged the prominence of soul food by transforming traditional charcuterie boards into “Soul-Cuterie” boards. Sprite, meantime, was lauded for its musical campaign with hip-hop artist Coi Leray.

“These brands were so successful in reaching Black America because they effectively engaged the passions of Black consumers,” said Sudipti Kumar, Collage Group’s director of multicultural insights. “Each of the top brands displayed that they understand Black consumer values and made intentional efforts to engage and support them.”

Kumar told Progressive Grocer that progress is being made in cultural fluency. "While there is a range of how different CPG brands are addressing cultural fluency, there is clearly a movement to prioritize it more in recent years. It can be harder to do in the CPG space than in some other categories that more naturally lend themselves to innate excitement, like travel or fashion. But there are brands who are trying to connect their products to the cultural moment to appeal to younger generations and to Multicultural consumers," she said, citing Jif and Oscar Meyer as examples of brands that have focused on reshaping their brand identity.

Collage Group’s insights also revealed that Walmart performs well among Black shoppers, driven in part by its approach of focusing on affordability and its overall commitment to uplifting Black consumers. “We know Black consumers have expressed concern about their financial circumstances, and recognize an overwhelming majority of Black Americans want brands to do something to combat social and political issues,” noted Zekeera Belton, Collage Group’s VP of client services and diverse segment strategist. “Walmart directly acted on these desires, and as a result, won over many of these consumers.”

Grocery chains and independent grocers are also supporting Black consumers and communities in various ways this month. Dom's Kitchen and Market in Chicago, for example, is donating 10% of all sales from Black-owned brands to the nonprofit My Block My Hood My City Organization and is featuring Black-owned brands on its e-commerce site. Michigan-based Meijer, which has continued to expand its procurement of products from diverse-owned companies, rolled out a collection this month featuring the works of three Black artists hailing from the Midwest and will donate proceeds of the sales to Urban League affiliates.

Other retailers, e-comm platforms and brands are taking time during Black History Month to outline recent and current initiatives aimed at fostering equity:

- Target Corp. has expanded its collection for Black History Month in 2023 to include more items from 100% Black-owned or designed makers and partnered with historically Black colleges and universities (HBCUs) to feature selections from its design challenge winners. Target also launched a new Black beyond Measure campaign this year.

- DoorDash shared that it is collaborating with its Black employee resource group to provide programs such as a Black Resistance with Tech panel discussion, a radical care workshop, a meetup at local office hubs with a virtual Black history tour and a virtual block party, among other activities. Beyond February, DoorDash is working to expand its Accelerator for Local Goods and its Dasher financial empowerment work, among other priorities.

- Retailers including Wegmans Food Markets and Stop & Shop are posting stories from team members on their respective websites. As it celebrates Black History Month, Wegmans asked its employees to share their stories around food, family and traditions.

Victor Paredes, Collage Group's executive director of cultural strategy, underscored the importance of having a rich and diverse pipeline of products. "Marketers are increasingly investing in the entrepreneurial and creative drive of Black creators, especially women," he said, calling out Vista and Doritos in particular. "One of the key reasons they resonate so well is because of their significant investment in Black creators. In turn, they have a rich feedback loop that affects the cultural competency of their financial literacy programming and even their brand positioning. Doritos also has a great program called Solid Black that truly celebrates and elevates Black creativity. It in turn affects product and packaging."

Meanwhile, recent market research reflects interest among Black consumers in connecting with products and stores that understand their tastes and preferences. According to a June 2022 report from the McKinsey Institute for Black Economic Mobility, Black consumers have several distinct preferences compared with their non-Black peers: 44% of Black respondents would choose a restaurant that offers food from their culture compared to 28% of non-Black consumers, and 43% want their grocery store to have a large collection of organic and natural food versus 36% of non-Black consumers.

The McKinsey report emphasized the power of messaging from brands and grocers to Black shoppers. “Although a growing number of grocery chains stock Black-owned food brands, these brands are not necessarily identifiable as Black-owned to consumers. This is a missed opportunity for brands and retailers. Grocery stores also tend to relegate their culturally diverse foods to an aisle — or a few — dedicated to ethnic and international foods, which forces Black consumers into a different shopping experience than the average shopper,” the report’s authors concluded.

Other market research reveals notable trends among Black consumers. Collage Group, for example, found that 64% of Black Americans say they find joy in cooking at home versus eating out, higher than the 54% response of the entire U.S. population. A third (63%) of 63% of Black consumers in this country say they seek new things to do, try, and see, including new foods and meals and 42% of the 88% of Black consumers who follow influencers or content creators on social media platforms look for food and cooking information.