H-E-B, Sam's Club Again Tops Among Brick-and-Mortar Retail Pharmacies: J.D. Power

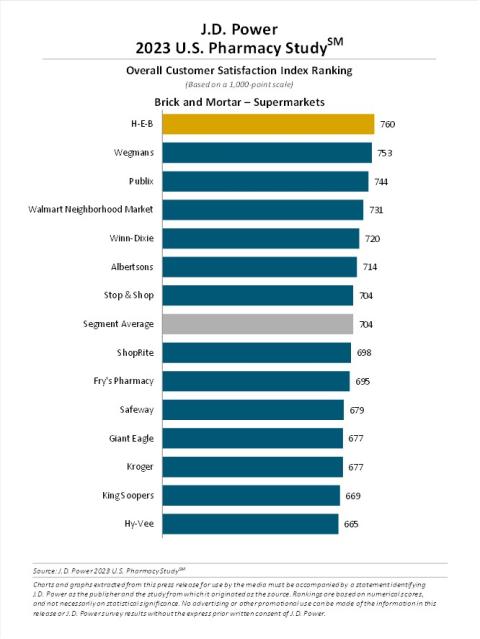

Among brick-and-mortar supermarket pharmacies, H-E-B ranked first in customer satisfaction for the third consecutive year, with a score of 760, while WegmansFood Markets(753) came in second and PublixSuper Market(744)was third, according to the newly released “J.D. Power 2023 U.S. Pharmacy Study.”

Sam’s Club earned the top spot among brick-and-mortar mass-merchandiser pharmacies for the eighth year in a row, with a score of 788, and Costco (755) came in second. Good Neighbor Pharmacy ranked highest among brick-and-mortar chain drug store pharmacies for the seventh straight year, with a score of 793, while Health Mart (770) came in second and Rite Aid Pharmacywas third (680). Kaiser Permanente Pharmacy ranked highest in the mail order segment, with a score of 748; PillPack (an Amazon company) (709) was second and Express Scripts Pharmacy (699) came in third.

[Read more: "Shoppers See Drug Stores as Grocery Destinations, Too"]

Despite the pharmacy’s evolution to an omnichannel hub of health care services and digital tools, personal interactions with staff are still key to lasting customer satisfaction. The study found that brick-and-mortar pharmacies are delivering on that promise of personalized service, leading to a six-point rise in overall customer satisfaction this year on a 1,000-point scale.Meanwhile, on the mail order front, overall satisfaction had also risen, but so had the likelihood of switching providers.

“As pharmacies continue to take on a more significant role in health care delivery and ongoing care management, the pharmacist has become a critical link in the health care continuum,” noted Christopher Lis, managing director of global health care intelligence at Troy, Mich.-based J.D. Power. “Customers are rewarding pharmacies that deliver personalized service, including interactions where communications occur on a first-name basis and when the pharmacist is available to answer questions. These elements of personalized service are moments of truth to help brick-and-mortar pharmacies forge meaningful connections with customers. Mail order pharmacies, by contrast, are less likely to have these personal connections and, in turn, are seeing declines in customer loyalty.”

Key findings from the 2023 study include:

- Overall satisfaction is 102 points higher among customers who said that they know their pharmacist by name, and 93 points higher among those who said that they know pharmacy staff or technicians by name.

- Overall, 83% of brick-and-mortar pharmacy customers expressed interest in receiving health-and- wellness services at their pharmacy, up three percentage points from 2022. Top services included vaccinations or flu shots (50%), health screenings (46%) and COVID-19 testing (42%).

- While overall satisfaction in the mail order pharmacy segment rose nine points this year, customer loyalty is decreasing. Some 18% of mail order customers said that they “definitely will” or “probably will” switch pharmacies in the next 12 months, up from 14% last year. Top reasons for switching included employer insurance requiring a change (31%), medication being too expensive (24%) and a desire for flexible pickup options (21%).

- Brick-and-mortar pharmacies experienced increases in digital engagement. In 2022, 76% of customers said that they relied on digital technologies to interact with their pharmacy. This year, 81% of customers said that they use digital technology.Among mail order pharmacy customers, 89% now depend on digital technology to interact with their pharmacy, up from 84% in 2022. Top digital channels cited by mail order customers were pharmacy websites (59%) mobile apps (34%) and text messages (29%).

Now in its 15th year, the “U.S. Pharmacy Study” gauges customer satisfaction with brick-and-mortar and mail order pharmacies. The 2023 study is based on responses from 12,396 pharmacy customers who filled a prescription within the past 12 months and was fielded August 2022-May 2023.