Happier Days Coming for In-Store Bakeries: PG Annual Report

Supermarket bakeries are as unique as the stores they operate in, with formats ranging from all-scratch production to thaw-and-sell, and every variation in between.

And that individuality — a key ingredient in creating a shopping experience unique from other retail channels — seems to be having a positive impact, according to the results of Progressive Grocer’s 2017 Retail Bakery Review, our exclusive survey looking at the state of the supermarket bakery nationwide.

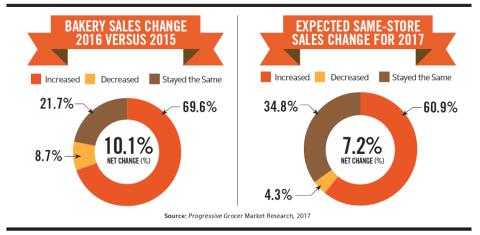

With most bakery products considered a treat by consumers, and sales that are mostly impulse, survey respondents reported healthy sales. Nearly 70 percent indicated that department sales had increased in 2016 over 2015, much higher than the half (52.8 percent) who reported the same in last year’s survey. Only 9 percent reported sales declines.

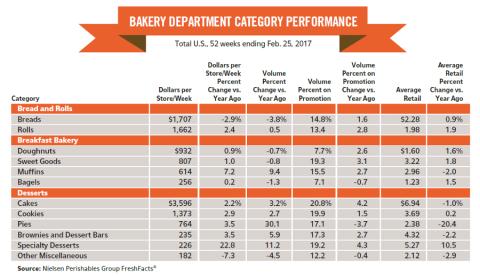

Bakery has traditionally been fairly recession-proof, but customers’ purse strings seem to have loosened a bit more compared with the past several years. Total annual sales for the supermarket bakery category were $11.6 billion, according to Schaumburg, Ill.-based Nielsen.

“We’ve continued to see sales grow,” says Christina Jessie, bakery sales and operations manager for Eugene, Ore.-based Market of Choice, a chain of 10 stores. “We’ve really have not had a big dip, no matter what the economy is. If we just do consistently good product, maybe other parts of the store might go up and down, but the bakery just seems to be really solid.”

According to the PG survey, the average net change for sales this year was 10 percent, a much bigger swing in sales compared with last year’s 3.6 percent net change.

For the remainder of 2017, optimism for increased sales continues, with 61 percent expecting sales to increase. Projected sales net change is 7.2 percent, nearly double last year’s 3.4 percent.

However, that optimism is a bit tempered by size of the grocery chain. All survey respondents from chains with 11 or more stores projected sales to increase, while more than half of respondents from chains with 10 or fewer stores were projecting sales to remain the same.

Profitability on the Rise

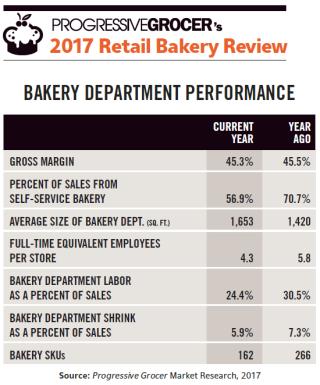

Bakery accounts for 7.2 percent of total store sales, with an average gross margin of 45.3 percent. Gross margin has remained essentially the same for the past several years. Gross margin was reported as 45.5 percent last year, and 45.2 percent the previous year.

When it comes to the department’s profitability, more than half of survey respondents reported that profits increased, while 21.7 percent indicated that profits decreased and about a quarter reported that they stayed the same. Larger chains, those with 11 or more stores, seem to be outperforming companies with 10 or fewer stores, with 66.7 percent of the larger chains reporting that profits were up, while only 42.9 percent of the smaller companies reported the same. Larger companies could be benefiting from efficiencies both in production and sourcing.

Many factors could contribute to the rise in profits. Respondents reported that shrink was 5.9 percent of sales, which is lower than last year’s 7.3 percent, so production is more evenly matched to sales. Labor as a percent of sales also was down: 24.4 percent this year, compared with last year’s 30.5 percent.

The number of full-time employees declined as well this year, with 4.3 full-time employees per bakery on average, compared with 5.8 employees reported last year. The decline in labor costs could indicate that bakeries are relying more on part-time help, or just improving efficiency.

What’s Hot?

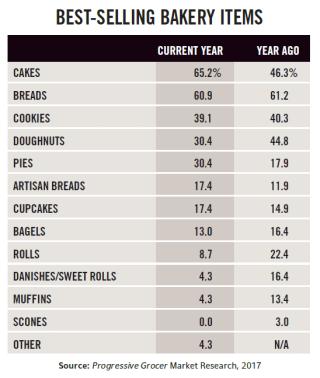

The department’s profitability also could be influenced by the top-selling products. Cakes, back on top of the list of top-selling products, are by far the most profitable product. They had lost the top spot last year to breads, which came in second this year on both the top-selling and most profitable products lists. Artisan breads, which ranked fourth in profitability, saw an increase in the top-selling ranking, with 17.4 percent of survey respondents ranking them as top-selling items, compared with 11.9 percent last year.

The top-selling products have seen some shifts, but the top four — cakes, bread, cookies and doughnuts — retained those slots, although they jockeyed for new positions within that space. Other products have seen their ranking on the list shift. For example, pies broke into the top five, with 30.4 percent rating it a top-selling product, compared with only 17.9 percent last year.

For Jessie, cakes are the top seller, but cookies are rising in popularity, at Market of Choice. “I cannot make enough kinds of cookies,” she says. “If you make them well, price is really not an issue. In our market, they want good quality. What we focus on is old-fashioned recipes made with real butter and locally milled flour — high-end ingredients.”

What’s Not?

Other products saw their sales drop. Rolls fell out of the top five, seeing a significant decline from last year; only 8.7 percent ranked them as top sellers this year, compared with 22.4 percent in 2016.

Muffins and danishes/sweet rolls also saw their sales decline. Just 4.3 percent ranked muffins as top-selling items this year, compared with 13.4 percent last year, while danishes/sweet rolls dropped from 16.4 last year to 4.3 percent this year.

Jessie saw a similar phenomenon at Market of Choice, with a drop in sales of cinnamon rolls and muffins as well as other breakfast items.

“People want that splurge, but they don’t all necessarily want to start their day with the same items that they used to,” she notes. “For breakfast, we’ve gone into more granolas. Things like that are doing really well right now.”

However, Tony O’s Supermarket, in Kingsville, Ohio, is still seeing strong sales of cinnamon rolls. Owner Tony Orlando upgrades a thaw-and-sell product by making his own “schmear” with brown sugar, butter and lots of cinnamon, and injects it directly into the roll, so it contains three times the amount traditionally found in a cinnamon roll. He then tops the pastry with scratch-made icing. “It’s real simple, and most people still like their junk food,” Orlando says.

What’s Next?

As any good bakery executive knows, you can’t rely on what sold well in the past; you have to look forward to what’s going to sell well tomorrow.

Celebration cakes have the strongest growth, the survey revealed, followed by seasonal specialties. Signature/specialty items come in third, with gluten-free and smaller-portion products rounding out the top five products with the best growth potential.

Gluten-free and smaller portions fit in with the healthier eating habuts that many consumers claim to be adopting. At Tony O’s, Orlando predicts that the next big trend will be products that fit into both gluten- and sugar-free lifestyles. Many of his sugar-free products already are gluten-free as well. “The biggest gap that needs to be filled is actually doing a gluten-free/sugar-free combination, because both disorders almost run hand-in-hand,” he notes.

“The trend is not fully developed as much as I believe it should be.”

Among its products of this type, Tony O’s offers brownies made with “fluff,” or mousse, that are both gluten- and sugar-free, as are the grocer’s nut roll tortes.

Bakery Positioning

Perishables departments such as bakery have become increasingly important draws for customers. Nearly half (43.5 percent) describe their bakery department as part of a “one-stop-shopping” format, while 39.1 percent see it as a destination department. More than two-thirds (34.8 percent) indicate that their department offers only the basics or necessities, and 30.4 percent use the department as an image builder.

“I think we are a strong draw for our stores,” Jessie says of her stores’ bakery departments. “We’re really unique and we are really fortunate to be placed towards the front of the store, so we are the first things that you come in to see. We’ve developed a following.”

Part of that following could be Market of Choice’s strong focus on signature products, which 82.6 percent of all bakery departments offer. Also like Market of Choice, nearly three-quarters of the departments bake those products in-house.

No matter what the PG survey says is popular, bakery execs need to remember who their customers are.

“Know who you are and who your customers are. Really focus on providing for that,” Jessie advises. “Not varying to a lot of wild trends, but make sure that your core products are out there, available all the time, and that your customers can depend on it.”

Orlando agrees: “The trend around here is staying true to what you do.”