Hot Grocery Trends for Summer 2023

Shopper intelligence leader Catalina is projecting a significant sales uptick in new beverage and tableware options at grocery and convenience stores across the country in the coming weeks, based on its proprietary Shopper Intelligence Platform, which identifies audiences and measures purchase behavior in real time.

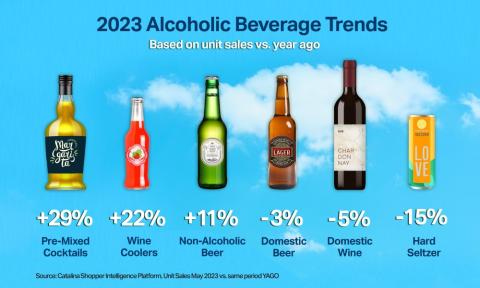

In the adult beverage category, demand for pre-mixed cocktails is anticipated to rise, while hard seltzer is in decline.

[Read more: "EXCLUSIVE: Entertainment, Enjoyable Experiences on Tap at In-Store Bars"]

“We expect pre-mixed cocktails to be well stocked in picnic coolers across the country this summer, at the expense of hard seltzer and domestic beer and wine,” said Sean Murphy, chief data and analytics officer at Catalina, whose global headquarters is in St. Petersburg, Fla. “Hosts can now conveniently offer a wider variety of flavors and styles – from a classic margarita to fruit-infused vodka spritzes – that are typically more affordable than buying individual ingredients. They are also lower in calories and sugar than many other alcoholic beverages.”

Overall, Catalina noted that the pre-mixed cocktail category is expected to grow by 11% year over year in 2023 and is becoming increasingly competitive, with major players driving innovation to differentiate themselves. Catalina data showed that the 29% growth of pre-mixed cocktails has outpaced other alcoholic beverage categories since May 2022, followed by wine coolers, at 22%, and nonalcoholic beer, at 11%.

At 51%, Catalina's Shopper Intelligence Platform showed that liqueurs were the most popular base ingredient in the pre-mixed cocktails category, followed by beer (46%), gin (43%), tequila (42%) and vodka (30%).

The popularity of pre-mixed cocktails is coming at the expense of hard seltzers, which dropped 15% in unit sales compared with last year. Additionally, domestic wine decreased 5% and mainstream beer shrunk 3%. Notably, the consumption of beer cocktails such as shandies and ginger beers is on the rise – up 46% versus a year ago – while, as mentioned earlier, nonalcoholic beer has seen an 11% increase.

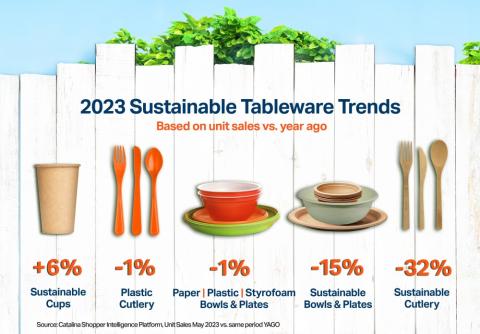

In the tableware category, sustainability might be losing its luster. Unit sales of sustainable bowls and plates declined 15% and cutlery plummeted 32%. According to Catalina, this category has taken a deep dive since last year as impact studies continue to report that sustainable plastic tableware products don’t fully break down in landfills. The convenience of sustainable cups is an exception, with a category sales increase of 6% versus the same period in 2022. Meanwhile, unit sales of plastic cutlery and paper/plastic/Styrofoam bowls and plates both slightly fell 1%.

As an alternative, Catalina pointed out that hosts are increasingly opting for tableware made with melamine, an organic compound, as a value-driven sustainable alternative. The size of the U.S. market is expected to grow to $1.3 billion by 2030, with a compound annual growth rate of 8%. When comparing costs, a set of basic melamine plates costs about $10, while disposable plates cost $5 – so hosts who use them more than twice can save money and help the environment.

“Taking a close look at shopping trends throughout the year enables us to better advise our retailer and CPG brand customers on how best to connect with a variety of audiences most likely to buy a given product, as well as those who may need encouragement, with messaging and promotional offers to influence their buying behavior and provide added value,” observed Murphy.