How SNAP Shoppers Are Changing Their Buying Habits

Since the last of the pandemic-era emergency allotments (EAs) expired at the end of March, users of the Supplemental Nutritional Assistance Program (SNAP) have responded with new concerns and different shopping behaviors, according to research from The Kroger Co.'s 84.51° customer analytics arm.

The end of the COVID-related benefits came at a time of still-elevated inflation and ongoing concerns about the state of the national and global economy, which have exacerbated SNAP users’ worries about providing food for themselves and their families. “Of the households that receive SNAP benefits, 62% report that the cancellation of the emergency allotment benefit had a significant impact on their overall household budgets,” said Bridget Allerton, director of commercial insights at 84.51°, during a recent interview with Progressive Grocer.

[Read more: “DoorDash Rolls Out SNAP/EBT Online Payments’]

She emphasized the scale of the impact, given the fact that 42 million U.S. households receive monthly SNAP benefits. “Two-thirds of SNAP participants are families with children, who are key customers for grocers. It’s truly a significant customer base that grocers need to pay attention to and meet their needs,” Allerton remarked.

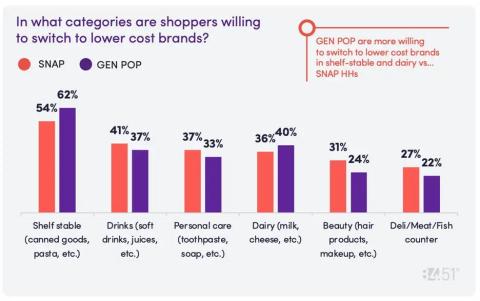

Although the EA benefits were phased out over time, more than two-thirds (64%) of shoppers reported that their allotments were canceled in March, meaning that they only recently began changing their grocery shopping habits to adjust to the budget change. To meet both their financial and dietary needs, SNAP customers coping in different ways.

For one thing, these shoppers are cutting back on certain purchases. Data from 84.51° shows that 56% of SNAP consumers are buying less snacks and candy, 47% are scaling back on shopping at the deli, meat and fish counters, 43% are curbing purchases in the fresh bakery and 41% are opting for fewer beverages, including soft drinks.

SNAP shoppers are also using tools offered by grocers, including money-saving solutions. Top promotions valued by SNAP households include, in descending order, digital coupons (57%), weekly digital deals (47%), BOGO offers (41%), 10 for $10 promotions (38%), clearance bins/shelves (35%), circulars/weekly ads (31%) and fuel points (28%).

Shopping in the e-commerce channel can also help SNAP customers optimize their budgets and improve access to nutritious foods. “Sixty percent of households said they found SNAP-eligible products online extremely easily, so the online channel is a way to deliver value,” Allerton pointed out, citing Kroger’s approach as an example. “Kroger is particularly focused on indicating wither or not a product is SNAP or EBT eligible. And when checking out online, the customer has the opportunity to check out using a SNAP benefit or gift cards, so it’s very clear.”

Engagement in the digital channel has risen as EA benefits lapsed, the data revealed. “Kroger’s delivery sales are up 68% among shoppers who use SNAP benefits. We see that shoppers value convenience,” Allerton noted.

84.51° also reported that grocers have some competition for SNAP purchases. In addition to traditional grocery stores, shoppers are spending their benefits at mass retailers (62%), convenience stores (40%), gas stations (33%), Amazon (28%), farmer’s markets (16%), pharmacies (6%) and local food cooperatives (4%).

Serving 11 million-plus customers daily through digital shopping and retail food stores under a variety of banner names, Cincinnati-based Kroger is No. 4 on The PG 100, Progressive Grocer’s 2023 list of the top food and consumables retailers in North America. PG also named the company one of its Retailers of the Century.