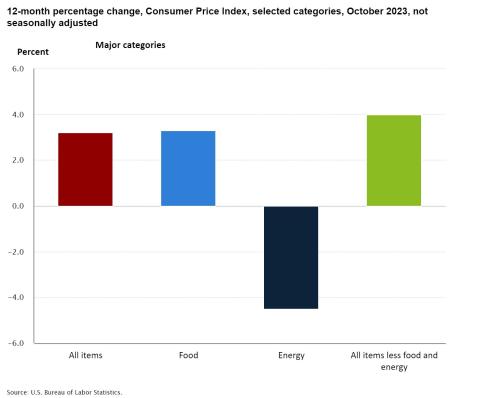

Overall Inflation Cools, Grocery Ticks Up Slightly

Heading into the holiday stock-up season, the grocery inflation rate remains somewhat elevated. The “somewhat” is the good news for grocers, as food prices have moderated from 2022 peaks.

According to the U.S. Bureau of Labor Statistics (BLS), the Consumer Price Index (CPI) for food at home rose 0.3% in October, following a 0.2% hike in September. On a yearly basis, grocery inflation is up 2.1%.

[Read more: "Food and Beverage Poised for More Promising 2024: Report"]

The overall CPI stayed the same last month, beating analysts’ expectations. That news also prompted some observers to declare that the immediate recession risk is now lower.

Several categories within the grocery sector experienced yet another slight-but still-unwelcome increase last month. The CPI for meats, poultry, fish, and eggs went up 0.7%, with retail beef prices edging 1.2 % higher and the index for pork rising 1.3%. Dairy and related products ticked 0.3% higher and the CPI for cereals and bakery products grew 0.2% for the month after falling 0.4% in September.

Meanwhile, inflation came in lower for nonalcoholic beverages (-0.1%) and the CPI for fruits and vegetables remained the same in October.

The latest inflation data affirms grocers’ ongoing focus on providing price relief and value to consumers ahead of the big holiday rush. “The October CPI report reminds us that even though inflation has cooled significantly since the highs witnessed in the summer of 2022, the economy continues to provide a few ‘head fakes,’ as Federal Reserve Chairman Powell noted last week,” remarked Andy Harig, VP of tax, trade, sustainability and policy development at FMI - The Food Industry Association.

He also cited recent findings from FMI’s latest holiday shopper trends report showing that 42% of consumers are worried about having enough money to pay for food this season and 45% are looking for deals or only buying products on sale. “Yet the majority of those shoppers — 77% — say they are proactively taking steps to address rising prices during the holidays, with 47% telling FMI they are cooking more or differently,” Harig added. “This includes 53% of shoppers who say they plan on eating more at home in the coming year, compared to just 14% who plan to dine out more.”