Protein Report: Pork

It’s been called “the other white meat.” It’s often compared with beef. But pork is its own animal in many ways, including how processors and brands are working to compete with several animal- and plant-based proteins in an increasingly jam-packed marketplace.

Innovations in product development, along with changes in consumers’ eating and meal preparation habits, have helped elevate this protein segment. Data from the U.S. Department of Agriculture (USDA) shows that overall pork consumption has hovered around 50 pounds per capita for the past 50 years, but the forecast consumption for 2021 is expected to rise by 0.5 pounds. This represents a notable increase from a low of 45.7 pounds a decade ago.

Like everything else, the pandemic had a ripple effect on pork as a form of protein. In general, meat department sales got a 19.2% bump from 2010 to 2020, for a total of $82.5 billion, according to the 2021 “Power of Meat” report from Arlington, Va.-based FMI – The Food Industry Association. Fresh pork sales reached $7.2 billion in 2020, up 19.2% from 2019. In processed meats, the latest “Power of Meat” report revealed a 20.8% lift in bacon, a 21% rise in dinner sausage, a 20.2% increase in breakfast sausage, a 19.8% gain in frankfurters and a 16% uptick in smoked ham.

Trial was the biggest thing to come out of the pandemic-related shift in lifestyles. “I think consumers really learned how to cook more than ever,” notes Ozlem Worpel, director, fresh meats marketing for Tyson Fresh Meats, which has its business unit headquarters in Dakota Dunes, S.D. “They tried new cuts and new recipes.”

It was a true discovery process for some shoppers, she adds, explaining: “One of the things we’ve learned from the pandemic is that everyone went to the meat case. If the cuts that they were used to and familiar with sold and were out of stock, they said, ‘I need protein,’ and then bought more of what was available.”

Once they brought those cuts home, including pork cuts, people figured out what to do with them. “They Googled for recipes, they tried it, and they liked it,” Worpel recalls.

Now Trending in Pork

Ground pork is one segment within the fresh pork category with a new dynamic. “Ground pork really increased in that pandemic time,” agrees Worpel. Even if ground pork sales have edged downward from previous highs, they’re still higher than before the pandemic, she adds.

Information from the National Pork Board confirms that ground pork is growing and outpacing ground poultry. Ground pork has gained share within pork overall, notching 18% growth, according to the Des Moines, Iowa-based board.

In a recent e-newsletter article, the National Pork Board notes that retailers can diversify their meat cases and attract shoppers by adding ground pork to their ground meat offerings of ground beef and ground poultry. “The opportunity is further ripe for retailers, since ground pork is only 3% of all pork sales,” the article points out.

Underscoring the importance of exposure to shoppers, the board recommends merchandising pork alongside other ground meat products. The newsletter article cites an IRI Innovation Opportunity study showing that just six additional items per store would yield 41% more sales, bringing the category an additional $71 million.

Akin to ground pork is ground pork sausage, used as a versatile, flavorful ingredient. Earlier this year, Coleman Natural Foods, of Golden, Colo., launched a line of 16-ounce roll-style ground pork sausage made with pork sourced from American Humane Certified family farms. Available in original and hot varieties, the ground sausage can be used in traditional breakfast meals and as an ingredient in entrées like pasta sauce or pizza toppings.

On a seasonal basis, pork-based favorites for the grill are heating up with the arrival of summer. According to a new survey from the National Hot Dog and Sausage Council and the North American Meat Institute, 73% of consumers in the United States believe that a cookout isn’t complete without hot dogs. The groups also found that hot dog sales rose almost 20% during the pandemic and stayed 8.6% higher in April 2021 versus April 2019.

New hot dog products available this year include Ball Park Fully Loaded Nacho Cheese Franks from Tyson Foods Inc. and all-natural uncured hot dogs from the Walhburgers brand, developed in collaboration with Coleman Natural Foods.

Also trending right now are convenience-oriented pork products, spanning both fresh and processed pork. Driving that trend is the fact that consumers are still preparing many meals at home, yet are looking for shortcuts for both ease of use and time savings.

To meet this demand, Tyson Fresh Meats recently introduced a line of seasoned pork loins available in four flavors, arriving first in Walmart stores and later expanding in distribution. “This product also fits with the convenience piece that consumers are looking for,” notes Worpel.

Grocers are offering their own takes on convenience, with value-added products in the meat case and deli. For instance, The Giant Co., based in Carlisle, Pa., offers a private label Cook-in-Bag line of proteins, featuring seasoned meats available in an oven-ready bag. Pork varieties include a Jamaican Jerk Style pork roast and a Triple Mustard and Honey pork roast.

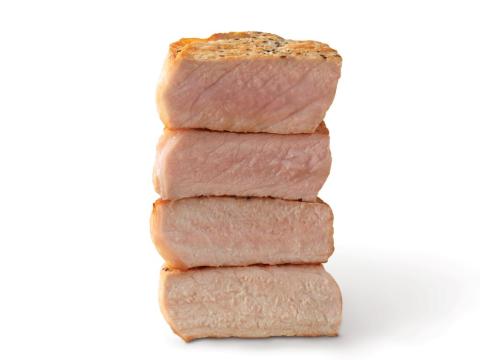

A Cut Above: Premium Pork

Another hallmark of today’s pork category is premiumization. This includes premium cuts of fresh pork as well as processed products like cured meats, which are part of popular charcuterie platters and kits.

In fresh pork, Tyson Fresh Meats is elevating its offerings with a new premium line of Chairman’s Reserve cuts, now available in several Target locations in the Midwest. The line includes a tomahawk chop, a ribeye chop, a New York chop and tenderloin medallions.

“During the pandemic, we found out that brands played an important role because of the trust factor. We wanted to bring more options to our customers and thought a case-ready program would be a great fit,” Worpel says, adding that the variety names were chosen to help guide shoppers. “We decided to use nomenclature associated with beef to give consumers a better understanding.”

The new line reflects a range of marketplace demands, she adds. “The main things were to provide consumers with portion control, longer shelf life, a safe product and, for retailers, something with less labor intensiveness,” Worpel observes.

Other types of pork products are getting a premium lift, too. Niman Ranch, based in Westminster, Colo., has come out with a new line of breakfast sausage, including applewood smoked bacon breakfast sausage and sweet Vermont maple breakfast sausage; Belcampo Meat Co., in Oakland, Calif., has rolled out new artisanal deli meats, including Smoked Berkshire Ham and Berkshire Bistro Ham; and major pork player Hormel Foods, based in Austin, Minn., recently added new Lloyd’s Pecanwood Smoked Pulled Pork made with Pig Beach Mustard BBQ sauce and a new line of Natural Choice hardwood smoked lunch meats.

Creative Takes on Pork

Innovation is a hallmark of protein product development over the past year and a half. The most recent “Power of Meat” report from FMI shows that 56% of retailers employed innovation in 2020, up from 49% the previous year.

Within the pork sector, innovations reflect consumers’ tastes and habits, from the ongoing popularity of high-protein diets to the desire for new and interesting flavors and formats.

High-protein snacks are one example, encompassing a variety of pork options. Powerhouse pork brand Smithfield, of Smithfield, Va., recently launched a line of Meat Lovers Power Bites featuring bites of premium sausage, bacon and ham, along with eggs and cheddar cheese.

Wilde Brands, of Golden, Colo., now offers a high-protein pork snack with the recent debut of its Pork Chips. The chips are made with 100% premium pork meat and are available in several flavors, including Golden Mustard BBQ, Sweet Chipotle, Black Pepper Bacon and Chili Lime Verde.

Innovation also includes new formats and fresh takes on classic items. This year, Johnsonville Foods, based in Sheboygan Falls, Wis., introduced Sausage Strips, fully cooked sausage products that look and cook like bacon. The sausage strips are available in original, spicy, maple-flavored and chorizo varieties.

“At Johnsonville, we are obsessed with sausage, so naturally we’re always looking for new ways to enjoy it,” explains brand manager Steve Bembenista. “When we thought to slice sausage like bacon, and then combine it with great sausage flavors like maple, chorizo, spicy and our original recipe, we thought we had a pretty darn good idea and needed to share it with the world.”

Pork Meets Plants

The rise of plant-based alternatives to animal-based products has affected the pork category also. As with other proteins, blended products made with both real pork and plant-based proteins have been developed to appeal to omnivores who say they want to add more plant-based food to their diets, but don’t want to give up meat entirely. FMI’s 2021 “Power of Meat” report shows that an overwhelming 82% of shoppers are interested in blended items.

Bridgewater, N.J.-based Applegate Farms, a brand of Hormel Foods, recently created Organic Asian Style Pork Meatballs made with brown rice, green onion, carrot, parsley and pork. The meatballs are part of the Well Carved line of blended products that also include beef and turkey burger blends and turkey meatballs.

Further, plant-based hot dogs are emerging in time for grilling season. Greenleaf Foods, a subsidiary of Mississauga, Ontario-based Maple Leaf Foods, has introduced premium naturally smoked Field Roast Signature Stadium Dogs made with pea protein, while the Sweet Earth brand from Arlington, Va.-based Nestlé USA has released a new vegan jumbo hot dog made using pea and potato protein.

A new pork alternative is hitting the market with the launch this year of the 100% plant-based OmniPork line from Hong Kong-based manufacturer OmniFoods. Made with a combination of plant-based proteins from non-GMO soy, peas, shiitake mushrooms and rice, OmniPork is being introduced first in foodservice and will expand to a broader foodservice and retail rollout later this summer. Options include ground, strips and luncheon alt-meat items.

The economics of pork are a bit complex heading into the back half of 2021.

On one hand, the price of pork increased 2.6% in April and is 4.8% higher from this time last year. This increase can be attributed to high feed and fuel costs, ongoing labor shortages, and consumers who are eating more pork products when dining out and cooking at home.

Meanwhile, some experts have predicted that a decline in demand in China will lead to lower prices in the U.S. marketplace.

In an article published in April, the Des Moines, Iowa-based National Pork Board broke down the supply-and-demand dynamics: “More limited domestic pork supply has pushed up prices. But pork is not alone, as prices are up for all proteins, so inflationary pressures are part of the current reality. Pork remains competitive with other proteins, as evidenced by the relative price of various pork cuts versus beef and poultry options. And while hog slaughter this fall may be slightly under 2020 levels, it will be higher than the five-year average. This suggests adequate pork supply for U.S. retailers and foodservice operators during the year-end peak demand period.”

Ozlem Worpel, of Dakota Dunes, S.D.-based Tyson Fresh Meats, agrees that the outlook is a bit murky, given the many variables affecting the pork market, such as the export situation, channel demand and freezer inventory. “There are a lot of unknowns,” Worpel admits. “We know we need more hogs and demand is high, but at the same time, we know that plants are still having labor challenges. I wish I had a crystal ball to tell you where it’s going.”