Strategies to Boost Beef Sales in a Changing Marketplace

Astalwart of the meat case, beef remains a king of protein. Per capita consumption of beef came in close to 60 pounds per person (59.4) in 2022, the highest level since 2010.

The kingdom of protein is shaping up to look a little different this year, though, thanks to the ultimate drivers of supply and demand. An ongoing high inflationary market, anticipated tightening in supplies, and an uncertain drought outlook could affect consumers’ steady demand for this red meat.

Bridget Wasser, associate director, customer insights for Chicago-based marketing and research firm Midan Marketing, agrees that cattle supplies might contract in the next several months. “Looking ahead to 2023, analysts expect a 7% decline in total beef production, which may lead to tighter supply, which will likely lead to higher prices for shoppers at the retail meat case,” notes Wasser.

As projections play out, recent research shows that consumers are adjusting to the various headwinds. According to the Centennial, Colo.-based National Cattlemen’s Beef Association (NCBA), retail beef sales hit $20.1 billion for the first 28 weeks of 2022, up 4.6% on a year-over-year basis.

Although there’s price inflation behind these figures — essentially, consumers spent more per pound on beef but bought fewer pounds — the data reveals that beef is still a favorite choice for at-home meals. NCBA found that 91% of those who bought beef roast and ground beef are satisfied with their eating experience, and that 93% of those who purchased beef steak are happy with their choice.

Bull Run

In this good news/bad news environment, retailers can take different approaches to sustain beef purchases.

For example, Wasser notes that food retailers can tap into consumers’ continued penchant for cooking. “Looking forward, we expect shoppers to continue to cook more at home, due to economic pressures and habits formed during the pandemic,” she says. “Beef offers a convenient and flavorful entrée, and it is a great go-to for home cooks.”

Kent Harrison, VP of marketing and premium programs for Tyson Fresh Meats, based Dakota Dunes, S.D., shared that assessment. “Consumers are looking for creative ways to stretch their dining budget by preparing restaurant-quality meals at home,” observes Harrison.

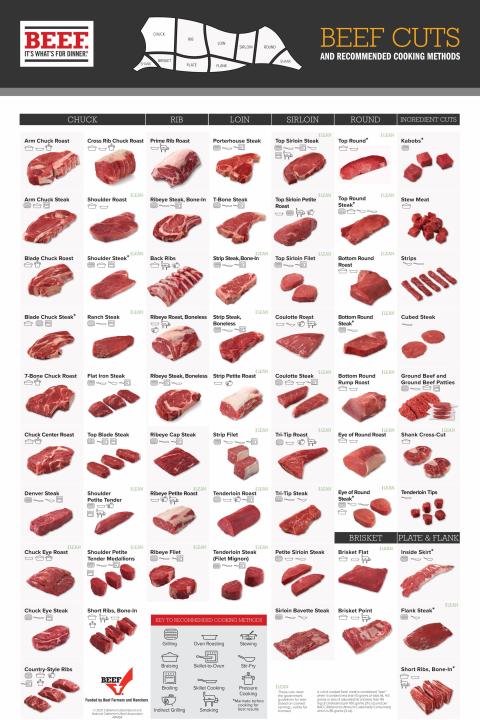

When it comes to assortment, variety will be pivotal in keeping beef in shoppers’ baskets, he adds. “While we are seeing increased demand for alternative cuts and roasts, consumers are still seeking out premium meats, so retailers need to continue offering high-quality options in the meat case,” says Harrison, highlighting the example of Chairman’s Reserve Platinum Angus beef, which provides a quality eating experience at an attractive price point.

Steve Coley, head of marketing for the One World Beef alliance of quality brands, in Solana Beach., Calif, agrees. “One World Beef’s program portfolio supports a range of price points: Our flagship Brandt Beef program offers family-owned, single-source Prime and Choice beef to provide the at-home chef with a no-compromises restaurant-quality experience every time,” explains Coley. “For value-oriented consumers, Brawley Beef still offers a Southern California-raised program that we produce in Choice and Select grades. In addition, we consult with our in-house Michelin-awarded chef talent to explore a variety of alternative, sometimes nontraditional cuts for customers looking for great-performing steaks outside of the typical ribeye and filet.”

Some food retailers are leveraging their store brands to capture a share of the beef dollar. Grand Rapids, Mich.-based Meijer Inc., for example, offers several case-ready cuts as part of its Frederik’s by Meijer private label portfolio; those cuts include prime beef ribeye steak, New York strip steak, top sirloin steak and ground chuck. Meanwhile, Batavia, Ill.-based Aldi US offers a Cattlemen’s Ranch line of portioned cuts that includes a corned beef brisket and bacon-wrapped filet, and Cleveland, Ohio-based Heinen’s recently added grass-fed-and-finished organic beef to its line of Heinen’s Organic Beef.

These days, convenience also grabs consumers’ attention at the beef point of sale. “It’s important for meat cases to have options,” notes Harrison. “Portion-cut products, as well as pre-seasoned and marinated proteins, are convenient and deliver consistency in serving size and quality. They also eliminate the prep work for a consumer, which is a huge value.”

As retailers diversify their beef offerings, they’re also adding products aimed at mindful consumers. “Modern consumers are definitely becoming increasingly invested in knowing more about their beef,” affirms Coley, citing One World Beef’s programs, which also include an all-natural single-source line from Brandt Beef and an organic grass-fed line from Imperial Valley Organics.

Harrison also points to the rise in food-conscious shoppers. “Another consumer to watch is the shopper, who, despite rising costs, is still looking for products with natural and claims-based messaging,” he says. “In recent years, consumers have been transitioning to meats with ‘no hormones,’ ‘no antibiotics’ and ‘humanely raised’ claims.” One Tyson product line that addresses such preferences, he adds, is the Open Prairie Natural Meats portfolio featuring beef products that are minimally processed, with no artificial ingredients.

Likewise, New Zealand producer Silver Fern Farms has found that the market for grass-fed beef is growing. “It’s gone from commodity to good for you, and now good for the environment,” recounts Matt Luxton, the company’s global strategic sales manager. “Grass-fed was about 5% of the market about six years ago, and now we are talking 10% to 12% of the retail environment. Grass-fed buyers also tend to have a bigger basket than the average consumer buying commodity beef.” Luxton notes that Silver Fern Farms’ products are currently distributed to more than 1,600 U.S. retailers.

Silver Fern Farms recently began selling Net Carbon Zero by Nature branded grass-fed beef New York strip steaks, Angus ribeye steaks and premium ground beef to stores in New York City and Los Angeles, and is planning to expand distribution in the coming months. “Net carbon zero beef is a big step forward ,and we are a bit ahead of the pack on that, with our connection with farmers,” says Luxton.

Grass Fed Foods, a Loveland, Colo.-based platform that brings together grass-fed category leaders Teton Waters Ranch and SunFed Ranch, has also seen interest in grass-fed beef skyrocket. “For many younger consumers, everything they purchase has higher standards,” notes CEO Jeff Tripician. “Whether it is regenerative, pasture-raised, free-range, antibiotic-free, organic, grass-fed, no sugar or Certified Humane — all of these standards and certifications are now part of the purchase lexicon of the young consumer. On the flip side, older consumers are driven more by food as a prescription for what ails them, so brands and foods that speak to their personal health-and-wellness goals translate more than those focused on animal welfare or climate. Claims like no antibiotics, no sugar and gluten-free drive this subset of the beef consumer.”

Beefing Up Merchandising

Beyond building a diverse meat case, retailers can deploy fresh merchandising tactics to ring up beef sales. “Retailers can leverage these changing behaviors by using sales and promotions to draw shoppers to the meat case, then use cross-merchandising and educational materials to help shoppers visualize how they can transform value cuts and roasts into creative meals,” advises Wasser.

At Silver Fern Farms, Luxton underscores the importance of strategic marketing. “At the end of the day, if we only did it in store, it would cannibalize sale from one brand to another,” he says. “So we are also outside the store, communicating to consumers to let them know the retailer has the product, to get them into the store to look for it.”

Other retailers have put a different stake — or should that be steak? — in the ground when it comes to their beef expertise. Boone, Iowa-based Fareway Stores Inc., for example, opened its second full-service Fareway Meat Market in its home state in 2022. The 7,800-square-foot store also carries a limited amount of produce, snacks, cheeses and adult beverages, among other items.

Walmart Inc., for its part, is taking the proverbial bull by the horns. The Bentonville, Ark.-based retail giant revealed last summer that it’s investing in Sustainable Beef, a Nebraska processor that can help the retailer sustain its beef inventory.

On their end, suppliers are working to maximize product availability. One World Beef, for its part, runs a vertically integrated operation with a plant in Brawley, Calif., that processes beef and produces a variety of custom fabrication and value-added services. According to Coley, “The close control we maintain over our process is how we are able to meet our customers’ needs in a collaborative manner.”