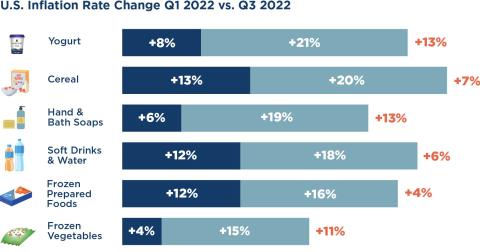

Which CPG Categories Are Currently Experiencing the Most Inflation?

While certain grocery categories are starting to see some relief from high inflationary prices, others are still showing few signs of downward momentum. According to Catalina’s Shopping Basket Index for the third quarter, U.S. shoppers continue to face double-digit price hikes compared to the same period in 2021, with yogurt and cereal seeing the biggest increases.

Yogurt prices were up 21% for Q3 year over year, while cereal prices were up 20%, hand and bath soap were up 19%, and soft drinks and water prices increased 18% during the time period, Catalina found. Frozen prepared foods, frozen vegetables, coffee and deodorant prices were also up by double digits.

[Read more: "The U.S. Has an Inflation Problem"]

Catalina’s report also looked at inflation in France and Japan. The cost of soaps and detergent is increasing fastest for Japanese consumers, while French shoppers are seeing paper product prices rise the most significantly.

"Inflation continues to be a big concern globally this year, with some nations' economies impacted more than others, largely due to increases in the food and energy sectors thanks to lingering supply chain disruptions caused by the COVID-19 pandemic and the war in Ukraine," said Sean Murphy, chief data and analytics officer at Catalina, which is headquartered in St. Petersburg, Fla.

As for retail and CPG marketers looking for strategies to combat inflation, Murphy suggests building omnichannel campaigns that include multiple digital channels and in-store point-of-sale offers in an effort to drive loyalty and sales lift. Other recommendations include developing targeted shopper cohorts, built from finely tuned audience segments, and using a real-time feedback loop to measure and adjust campaign performance.

"Insights about traditionally price-sensitive and value-seeking shoppers apply to more consumers now,” said Murphy. “This is an opportunity for brands to fine-tune their omni-channel approach to deliver relevant offers and valuable incentives to help shoppers make the most of their dollars in these inflationary times."

.jpeg?itok=PPwvSWS4)