Will Grocers, CPGs Help Banks Ride $100B Retail Media Wave?

More Retail Media Coverage

The digital advertising waters are shifting toward retail media, dramatically affecting how brands and retailers market to consumers. Countless articles have already been penned about the rising impact of retail media on the ad tech landscape, and for good reason: WPP’s GroupM estimates that retail media will be a $110.7 billion industry by the end of 2022, up from $88 billion in 2021. This represents 18% of all global digital advertising and 11% of all advertising, with estimates of that number climbing to 60% in 2027.

In digital media, money follows performance, and retail media is no exception. In one example cited by retail media solutions platform Criteo, it was able to increase sales for an art materials brand sold at Michael’s Crafts by 412%, with an increase in ROAS of 926%, using two creative ad formats: on-site display ads and sponsored products. This level of performance and measurability is unprecedented, with traditional online advertising leading brands to divert budget toward retail media at a rapid pace.

[Read more: "At a Crossroads: Progressive Grocer's 90th Annual Report"]

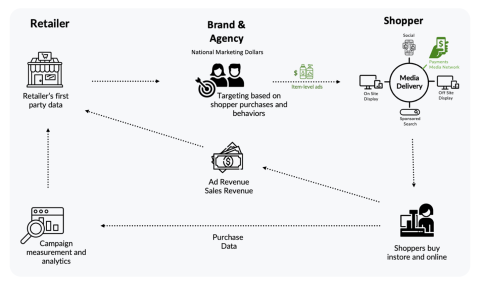

So, what’s the secret to retail media success? Brands are finally able to unlock retailers’ first-party data to target shoppers based on the actual purchases made online and in-store. This triangulation of granular retail purchase data and scaled audiences, combined with brands’ demand for better targeting and consumers’ desire for relevant advertising, has created a near-perfect situation up and down the value chain.

Consumer Banks Keep an Eye on the Prize

It’s no surprise that other industries with high-volume consumer interaction are investigating similar models. Banks are examining the value of their advertising assets, allowing third-party businesses to purchase advertising on their websites and mobile apps. Across significant geographic footprints, banks have first-party shopping data from large and engaged consumer audiences. They have many of the same attributes that retailers have, but with audiences hovering around 200 million and high visits — 66% of consumer banking customers open their banking apps at least once a week.

They’re not just checking their balances, though; they’re visiting their rewards programs that feature merchant-funded cash-back rewards programs. These programs drive high engagement for banks with deals from brick-and-mortar and online retailers like The Gap, Panera and Ross Simmons — all designed to drive card spending and maintain loyalty for the banks, with one significant limitation. The thing they all have in common is that the rewards are funded exclusively by the merchant, never by a vendor brand or offered on individual items at the SKU level. Also, these deals don’t include items in everyday spend categories like grocery, primarily because up to now, banks haven’t been able to track item-level spending, limiting the type of available offer to a percentage off the entire basket. The net result: No item-level deals equal no brand funding equals no retail media opportunity.

Bankers’ SKU Dilemma and Technology’s Solution

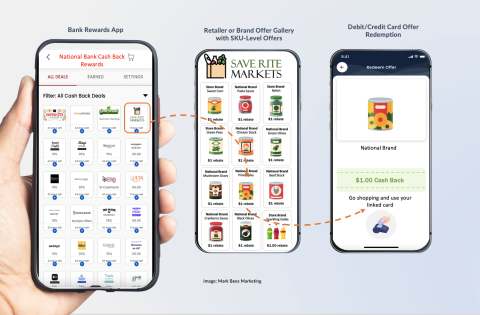

Right now, new technology is being designed to solve the item-level dilemma for banks, opening new marketing opportunities for brands and more savings for consumers who want deals on items that they buy in grocery and drug stores. It’s called a payments media network (PMN).

A PMN works like this. The cardholder’s bank offers cash-back discounts on brand-funded items at a nearby grocer: Buy X product and get Y cash back. Consumers use bank cards enrolled in PMNs to purchase products and receive cash-back rewards directly deposited to their credit or debit cards. As they walk through the store, consumers add the promoted products to their shopping baskets. At the cash register, they pay with the PMN-enabled credit or debit card. The PMN platform automatically tracks the rest. Consumers enjoy a seamless experience.

How a PMN Integrates With A Retail Media Network

The benefits are clear: Brands reach incremental shoppers beyond their retailer’s digital assets. Banks deliver more relevant value to their customers’ increasing share and spend. Retailers extend the reach of their retail media to off-site banking apps. Sound unbelievable? It’s coming to market soon.

Who Are the Players?

There’s a land grab on to make this a reality, and the competition is fierce, including legacy card-linked offer companies like Cardlytics, bank rewards platforms like Triple and even CPG loyalty platforms like Snipp that have long-standing CPG brand relationships to bring vendor offers into the mix.

Will payments media be the next wave of retail media? Only time will tell; however, considering consumer banking’s massive consumer audience reach, and precise targeting capabilities that will drive brands’ media investment, plus a simple redemption experience on personalized items in frequent-spend categories, it’s a technology that every grocery retailer and CPG brand should stay close to as it reaches its inevitable commercial launch.