2021 Consumer Expenditures Report

If the proof is in the pudding, it’s also in sparkling adult beverages, flour and cleaning products. Recent consumer expenditures data confirms what many thought about the impact of the global pandemic on shoppers’ spending habits – namely, that people prepared more meals at home, sought permissible indulgence and escapism, and tried to improve their everyday surroundings. Now, with the scales shifting a bit amid a return to mostly normal lifestyles, consumers are likewise changing some of their spending habits.

Recent consumer expenditures data indicates a mixed bag when it comes to shopper spending, both literally and figuratively. People bought a variety of products to get them through their frequent time at home, both for practical or indulgent purposes. They also spent their money across different channels in a rapidly evolving retail market. Today, purchases reflect another unique set of circumstances, with post-pandemic enthusiasm tempered by concerns about higher prices.

Delving into recent data, one can see how consumer expenditures exemplify a market defined by fluctuations.

The Big Picture

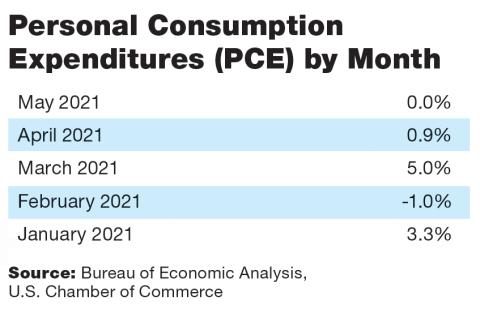

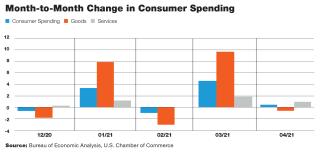

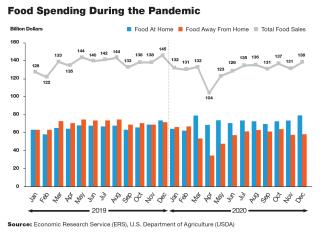

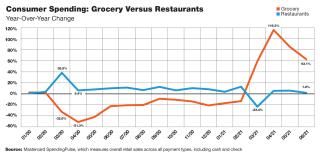

Data from the U.S. government reveals continual swings in consumer spending, largely attributable to COVID-19 surges and slowdowns, and, later, concerns about high prices. In short, volatility continues and the perennial factors of consumer confidence, wages and debt are also more up in the air in a tight labor market accompanied by other uncertainties.

According to the Bureau of Economic Analysis (BEA) of the U.S. Chamber of Commerce, consumer spending rose 11.3% from the fourth quarter of 2020 to the first quarter of 2021. In that time, spending on nondurable goods, including groceries, increased by 14%, and spending on durable goods, like cars, jumped 25.6%.

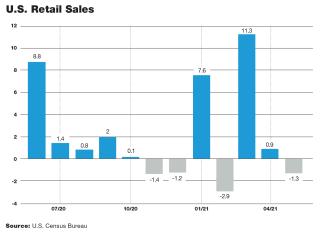

Retail Sales

In the retail sector, sales in the United States have been wavering from month to month. According to a report from the U.S. Census Bureau, retail sales dropped 1.3% in May as the pandemic slowed and consumers returned to dining in restaurants and going out for entertainment. Sales in April, though, were 0.9% higher than in the previous month.

Food Dollars in Flux

In food retailing, it has been less about trends and more about reactions that spur month-to-month changes in expenditures. This spring, for example, there was a readjustment of food expenditures to levels closer to pre-pandemic spending.

The Price Factor

Pricing is another wild card in consumer expenditures over the past year, both at grocery and in the overall marketplace, with higher prices for goods in many parts of the country and more recent concerns about inflation.

The Goods on Shoppers’ Spend

On a more granular basis, consumers spent their money on a little bit of everything as they contended with major lifestyle changes wrought by the pandemic. As people cooked and prepared more meals at home, pantry staples got the benefit of more sales, as did food and beverages that provided some kind of escapism or indulgence. Not surprisingly during a health crisis emanating from a transmissible virus, the health, self-care and cleaning supply categories received a bump in consumer purchases.

New and Notable

Grocers with an eye on current and future spending trends can get some actionable insights by looking at the top new products introduced in the past year. Despite many challenges in the marketplace, a spate of new products caught shoppers’ attention — and their dollars.

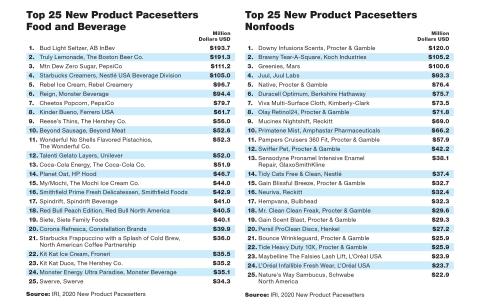

In its recently released “New Product Pacesetters” report, Chicago-based IRI ranked 200 high-performing new items that fit the bill for shoppers in 2020. According to the 26th annual report, many of these new products resonated with consumers as they spent differently — and typically spent more — on both necessities and items that made them feel better.

And spend they did: The latest “New Product Pacesetters” shows FEATURE 74th Annual Consumer Expenditures Report The Goods on Shoppers’ Spend On a more granular basis, consumers spent their money on a little bit of everything as they contended with major lifestyle changes wrought by the pandemic. As people cooked and prepared more meals at home, pantry staples got the benefit of more sales, as did food and beverages that provided some kind of escapism or indulgence. Not surprisingly during a health crisis emanating from a transmissible virus, the health, self-care and cleaning supply categories received a bump in consumer purchases. that more than a quarter of the items introduced before the pandemic in late 2019 or early 2020 had big gains and accounted for 51 of the total 200 Pacesetter products.

“The top New Product Pacesetters of 2020 accomplished a unique feat by achieving success in circumstances never before seen in the history of Pacesetters,” says Joan Driggs, VP of content and thought leadership for IRI. “Many shoppers made the leap to new products because their go-to brand was unavailable, but many also actively sought out innovation for new experiences, measured not just by dollars earned, but also by the ability to reach the intended audience.”

Fun and Functional Successfully Co-Exist

Given that adult beverages were Nos. 1 and 2 on IRI’s list of top new products, it’s clear that consumers were willing to pay for a sense of escapism and comfort. Alcoholic beverages represented eight of the 27 beverage Pacesetters and generated $547 million in 2020, compared with $198 million in 2019.

Balancing Act

Shoppers divided their spend between feel-good and better-foryou products, according to IRI’s 2020 “New Product Pacesetters” report. Indulgent items like Talenti Gelato Layers, Reese’s Thins and Cheetos Popcorn made the top 25, but so did Rebel lowcarb ice cream and Mtn Dew Zero Sugar.

Cleaning Up

Combine more time at home with worries about catching a virus, and you get a consumer base more willing to spend on household cleaning products.

- Two new paper towel products hit the top 10 list of nonfood Pacesetters.

- Four laundry products ranked in the top 25 list of Pacesetters. Downy Infusion Scents generated more than $120 million in sales alone.

Best Face Forward

Recent sales data shows that beauty items like makeup have bounced back, but the “New Product Pacesetters” report shows that face and skin care items were still in consumers’ baskets in 2020. Such products comprised 29 of the Top 200 Pacesetters, representing $378 million in sales. Moreover, the 17% share of total nonfood Pacesetters in 2020 was nearly double the rate of face and skin products chosen the prior year.

IRI’s 2020 New Product Pacesetters also identified enthusiastic buyers.

Income: Most Pacesetter brands skew toward upper income: $70K+

Family Size: Skew toward households with three or more people and with kids

Race: Skew toward Hispanic families who speak English

Generation: Skew toward Millennials and away from older Boomers and seniors

Age: Skew toward males and females ages 25-54

What’s in a Name?

While new products from large companies represented 22% of IRI’s 200 Pacesetters, they saw 50% of the dollars spent in 2020.

IRI defines company size based on U.S. revenues as:

- Big: More than $6B

- Medium: $1B

- Small: $100M

- Extra Small: Less than $100M

The Great Spending Shift

If what consumers are buying is changing, so is where they’re buying.

A lot of research has emerged in the past year on the quick pivot to online buying across a variety of channels and services. One recent survey showed that online sales in May 2021 dropped 16% from May 2020, but are still three and a half times higher than pre-COVID levels.

The magic question, of course, is whether the gains will hold against 2019 or early 2020 levels. A new survey from Skaneateles, N.Y.-based behavioral strategy and design firm ChaseDesign indicates that about half of grocery shoppers started doing online ordering and curbside pickup during the pandemic, but that only half of those consumers will continue those habits in the future.

- 54% of shoppers prefer to pick out items in person.

- 40% of shoppers want the experience of shopping in a physical store.

- Nearly half of shoppers who buy online and pick up in stores won’t buy meat or seafood that way, and about 40% avoid buying dairy, produce and frozen products online.

Source: ChaseDesign

Timing It Right

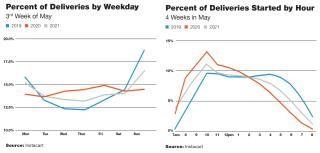

Instacart recently shared insights on its customers’ online buying habits, having found that when it comes to buying, there are some interesting trends in timing (See chart below).

For instance, although weekends are still the busiest time for Instacart ordering, there has been a notable increase in weekday orders and purchases earlier in the day. Further, while there are signs that the weekend pattern is re-emerging with the loosening of restrictions, shoppers seem to have retained their propensity for ordering earlier in the day.