Annual Report: Grocery Hit With a Wild Card

Read the Rest of the Report

(Editors' note: This is part one of a five-part series.)

They say that timing is everything.

When Progressive Grocer put its annual c-suite survey into the field, grocery executives were feeling pretty good about their prospects for a successful 2020.

And then came COVID-19.

The stock market tumbled. Economic disaster loomed. General chaos ensued.

Will grocers come out of the crisis unscathed?

Well, somebody has to sell sanitizing supplies, shelf-stable food and toilet paper.

“We had a positive outlook before the outbreak,” Anthony Hucker, president and CEO of Jacksonville, Fla.-based retailer Southeastern Grocers, tells PG. “Now there is an uptick in the obvious categories.”

Dave Hirz, president and CEO of Commerce, Calif.-based grocery chain Smart & Final, elaborates on this topic: “Prior to the impact of coronavirus, the economy had been really strong in the U.S., including Smart & Final’s markets in the West. We went into 2020 very optimistic, as consumers were feeling good about their financial position in general. Inflation had come back into the industry after the longest period of grocery deflation in more than 60 years, providing a tailwind for grocery retailers that we haven’t had since 2015.”

Ecommerce has remained a tremendous opportunity, Hirz notes, outpacing in-store growth and becoming a larger part of industry sales. “Private label penetration continues to grow industry-wide as well, giving retailers increased margin and additional leverage with our vendor partners,” he observes.

Amid the events of recent weeks, Hirz says he’s “very optimistic on the short-term — and longer-term — health of our industry. The impact of coronavirus is continuing to unfold in real time. During this uncertain period, we’re grateful to be in a position to provide customers the items they need.”

Of course, grocery retailers are critically important in times of crisis, and historically come through at their best.

“Even in [places] where most all retailers are closed, almost every grocery store continues to remain open, providing an essential service to those households,” Hirz notes. “[V]olumes have been unprecedented, and we believe that center store sales will remain strong in the short term, while the impact of coronavirus continues to be felt. Most of the product as customers stock up will be consumed, and we don’t anticipate a negative impact on future sales.”

The overall long-term impact remains to be seen, Hirz acknowledges, “but I believe sales will normalize as the virus runs its course and a vaccine comes to market,” he says. “The habits of cleaning, disinfecting and hand sanitizing might become a new normal and could drive up sales of those categories on a permanent basis. Right now, Smart & Final has a unique opportunity to show our current and new customers the quality and value we’re trusted for, and our associates are rising to the occasion.”

For its part, United Natural Foods Inc. (UNFI) is experiencing “significant” growth in sales due to the coronavirus outbreak.

In a second-quarter earnings call in March, Steven Spinner, CEO of the Providence, R.I.-based wholesaler, told analysts that the company is still watching to see what happens, but that “when you look at year-over-year growth ... our business is up double-digit versus prior year. That’s a big number.”

Spinner speculated as to whether consumers worried over COVID-19 are buying more groceries versus eating out.

“Are we going to see more and more people leaving the restaurants and eating at home? That’s possible. Are consumers loading their pantries? That’s possible. But obviously it’s very early,” Spinner said. “And so we certainly are uncomfortable making any predictions as to what this does to UNFI for the rest of the year, given the fact that right now, our primary focus is safety; security of the teams; security of the customers; making sure that our distribution centers are operating in a very, very clean and careful and disciplined way; and, obviously, making sure we get the product out into the retailer.”

Spinner identified around 400 items that are seeing the most lift, including frozen vegetables, frozen fruits, general staples, canned goods, rice, nuts and other food categories.

And since Spinner made these statements, local authorities across the country have ordered restaurants closed to dine-in customers during the outbreak, relegating their business at least temporarily to carry-out only and heralding increased pressure on grocery stores to handle a boost in eat-at-home behavior.

Certainly, total U.S. dollar sales for the one- and four-week periods ending March 7, as reported by Nielsen, are up by double — and in some cases, triple — digits, for products like hand sanitizers, disinfectants and multipurpose cleaners. Amid reports of hoarding, sales of bath tissue jumped 60% in one week as concerns over being quarantined sent folks scurrying for toiletries as well as canned goods and bottled water.

Unprecedented Road Ahead

Executives responding to our survey told us that they’re optimistic for a successful 2020. On a scale of one to 10, 82% of respondents rated their prospects for the coming year at a six or higher.

Nearly 80% rated their business success during 2019 at a six or higher, compared to 82% when we asked them a year ago about the prior year.

Compared with a year ago, nearly half (46%) are optimistic about success this year. About a quarter are less optimistic, with 29% feeling the same as last year.

Of key business areas, 29% of respondents told us that they expect their net profits to increase during 2020, with 49% expecting flat gains.

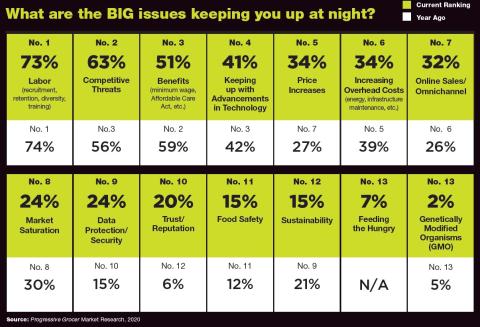

Reflecting those who told us that labor and benefits were among the top issues keeping them up at night, 93% of respondents told us that they expect wages to increase this year, likely a result of regional minimum-wage legislation as well as the need to attract top-notch talent in a market that, at least until the coronavirus outbreak, was experiencing historic low unemployment.

Additionally, 63% told us they expect to spend more on technology, a sure bet with the increased attention on omnichannel commerce.

To be sure, an already disrupted industry has been subjected to a new and historically unprecedented pathway of change since March 1.