2019 Retail Produce & Floral Review: The Primacy of Produce

Produce still stands strong as the main reason that customers select a primary store, according to Progressive Grocer’s annual Retail Produce & Floral Review, which informs readers about what’s going on in produce and floral departments across the United States. From CEOs to store managers, buyers to department specialists, this year’s review contains opinions for 2019 and comparisons to the 2018 report.

In the survey, labor is always a top issue for produce department managers: hiring, training, supervising and, many times, repeating the process. As one retailer says in the 2019 survey: “People are the most important ingredient to a successful produce operation. If you have the right people, they can make the produce department look like gold.”

Competition seems to be of somewhat greater concern this year, whether it’s from other supermarkets, Walmart, limited-assortment stores like Aldi or Lidl, or online.

Several retailers cite oversaturated markets. One respondent notes, “You have to maintain displays in the face of slower turns, with the increased competition.” Another retailer observes, “Costs are higher to buy produce for our store than for bigger chain stores,” and yet another says that because of competition, retail prices have had to be lowered, which affects gross profits. “Competition is brutal,” one respondent concedes.

Competition from other supermarkets was mentioned by 46% (up from 40% in 2018); Walmart by 34% (up slightly from 2018); other channels, including Aldi and farmers’ markets, by 30% (about the same); and online by 28% (up slightly). The fight for produce customers brought a response from almost 50% of respondents who are concerned about the price perception of fresh produce. These respondents know that produce can influence shoppers’ primary supermarket choice.

Although in the broad market, produce sales to date in 2019 were flat in comparison with the previous year, increasing only 1%, when asked how their produce sales had fared over the past six months, 53.7% of 2019 Progressive Grocer survey respondents said they had increased, versus 59% of respondents to the 2018 survey.

Further, when asked to project total same-store department sales for the entire year of 2019, 68.4% of survey respondents said that they would increase, down from last year’s survey, in which 72% of respondents expected that same-store sales would rise. Like last year, roughly one-quarter of 2019 survey participants believed that same-store sales would stay the same.

Fresh produce continues to convert and keep customers by a large margin, according to the 2019 “Power of Produce” report from the Arlington, Va.-based Food Marketing Institute (FMI). This surpasses the meat department and even total-store price image as a lure for conversion.

The Challenges Continue

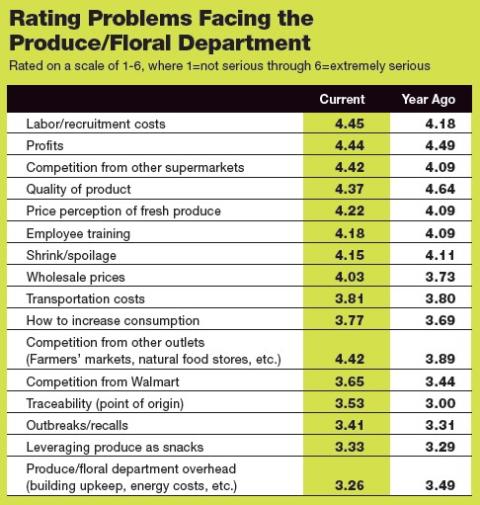

When 2019 PG survey participants were asked to rate the seriousness of issues facing their produce and floral departments, more than half of respondents cited three areas. The top response, labor and recruitment costs, received a rating of 4.45 out of 6, with profits right behind that, earning a rating of 4.44.

Competition from other channels and from other supermarkets tied with ratings of 4.42, while quality of product rounded out the top five, at 4.37. Employee training was seventh, with a rating of 4.18, right behind price perception (4.22).

“Educating associates so they can inform the customer is critical to the livelihood of any brick-and-mortar establishment,” says Jeff Cady, director of produce and floral at Williamsville, N.Y.-based Tops Markets LLC, which has more than 150 stores in New York, Pennsylvania and Vermont. “Without knowledgeable, friendly associates, why shop brick-and-mortar when you can have it delivered to your house? . . . We must educate to maintain our point of differentiation.”

“Produce is, and will always be, a service-driven department within retail,” notes Blake Lee, director of produce, bulk, procurement and merchandising for Carson, Calif.-based Bristol Farms, which operates more than 12 locations in California and is known for its organic produce. “Customers should be able to interact with produce clerks on a personal level. I think a major struggle in produce departments is trying to find the balancing act with labor and having the ability to have highly qualified individuals on the sales floors.”

Lee observes that that Bristol Farms offers customer service during the day on the sales floor, and also services fresh juice bars from the department. “By taking the time and investing in our employees, we can combat the training gaps that seem to be on the rise,” he says.

Jeff Wingo, supervisor of produce operations for Fredericktown, Mo.-based Town and Country Supermarkets, with more than 20 stores in the Show Me State, asserts that, “without a doubt,” personnel and staffing are the biggest challenges for the produce department.

“Creating an environment whereby you can create some retention from your associates is vital,” he stresses. “There is nothing more frustrating than spending four to six weeks training an individual, and then they decide that the grass is greener somewhere else.”

Shrink and profit are inextricably linked in produce departments, and both are a source of concern for department managers. As one survey respondent affirms, “Shrink is such a large percentage of cost and hits profits hard.”

Shrink and spoilage were concerns for 43% of those surveyed, down slightly from 47% last year. Several respondents mentioned poor-quality produce delivered to stores. Top efforts to reduce shrink ranked in the 2019 PG survey included use in prepared foods (57%, flat from last year); donation to food banks (51%, down from 56% last year); use in fresh-cut programs (49%, compared with 56% in 2018); and ugly produce (31%, a large drop from 42% last year).

In looking at departments’ physical needs, managers and merchandisers highlighted a lack of space and display equipment for the many new products rolling out.

“While the amount of different produce commodities themselves may not be growing that fast, the actual different ways they are offered is growing more each day,” says Tops’ Cady. He notes that trying to work these new items into his produce sets is difficult. “We only have so much space to put items, but consumers demand it, so it is forcing us to find ways to increase space,” he explains. “One might think, just cut back on the main item and make room for its offspring. The problem is, there are still plenty of people who want the main item. Trying to take care of every customer has always been a challenge, but one that must be met.”

Produce Components

The average gross margin percent reported in the 2019 PG survey was 33%, roughly the same as last year. Average net profit percent reported by respondents this year was 21%, the same as in 2018. Produce department average percent of total store sales was 17%, a very slight increase from last year.

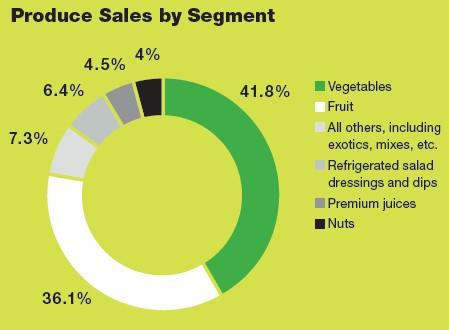

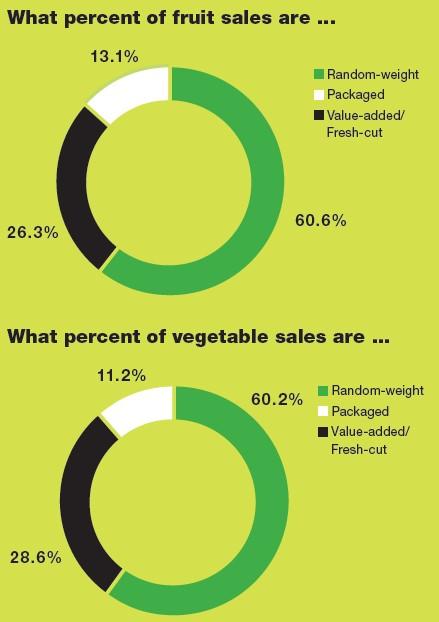

Vegetables are the primary produce purchase for respondents, at 41.8%, a slight uptick from 41% in the 2018 survey. Fruits were up a bit in second place, at 36.1% versus 33% last year. Sales of nuts were slightly lower, according to respondents, at 4% in 2019, versus 6% in 2018. Premium juices, and refrigerated dressings and dips were mentioned by 4.5% and 6.4%, respectively, with little change since last year. The “all other” category, which includes exotics and mixes, also showed little change, coming in at 7.3% in 2019.

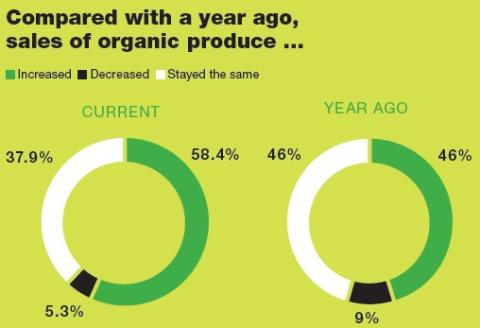

Sales of organic produce have increased, according to respondents in the 2019 survey, with 56.8% citing a larger percent of produce sold being organic, up from 46% in 2018. At the same time, 37.9% of respondents said there had been no change in organics sold, a large drop from 46% in 2019.

Some produce managers are concerned about “changing over to organic,” while others worry about “continued availability of high-quality organic local produce.”

In the most recent “Fresh Facts on Retail” quarterly report from the Washington, D.C.-based United Fresh Produce Association, organic produce dollar sales reached nearly $1.5 billion, which is 3.9% higher than the amount logged the same time last year. This represents 9.1% of all produce dollars in Q2 2019. Organic vegetables sold the most, but organic fruit also gained in sales.

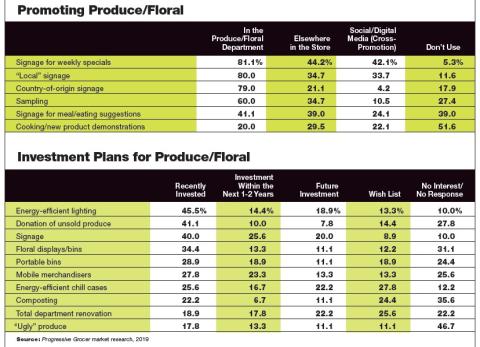

Signage for weekly specials within the produce department remained the most popular form of promotion, the current survey showed. According to respondents, 81.1% place signage within the department and 44.2% use it elsewhere in the store. Signage promoting meal and eating suggestions is used elsewhere in the store by 39% of those surveyed, and in the department by 41.1%. Signage denoting the local origin of produce is used within the department by 80% of those surveyed, and elsewhere in the store by 34.7%, while signage identifying the country of origin is used in the department by 79% and elsewhere in the store by 21.1%.

Sampling items is also strong in the produce department, according to 60% of respondents, and elsewhere in the store, cited by 34.7%.

Blossoming Sales

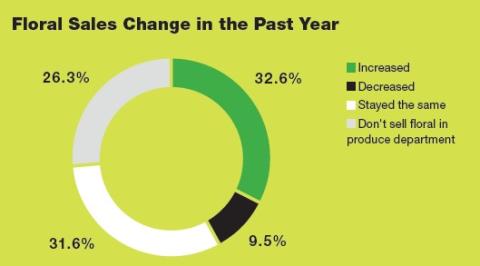

According to 32.6% of 2019 survey respondents, in the past year, floral sales have increased (roughly the same as last year, at 35%) while 31.6% said that sales stayed the same, up slightly from last year’s 28%. An additional 26.3% said that they didn’t sell floral in their produce departments.

And the Future . . .

Looking to the future, there are many opportunities and challenges for the produce department. “One thing we are facing … is sustainability in packaging, for stores and for the industry,” says Savidan. Southern California is beginning the move toward bans on plastic containers. “We will be using 100% compostable containers eventually,” he notes. “This will be huge for the industry. It’s like going back to where we started, with [pre-plastic] containers.

“I believe that the biggest challenge for produce departments today is the drastic weather/climate changes, which can be favorable to crops one week, driving costs down, and the next week, the opposite, creating product shortages driving cost and pricing up,” says Juan Estrella, produce specialist at Garland, Texas-based El Rancho Inc. Supermarket/Supermercado, which operates more than 20 stores.

Another area that produce departments are dealing with, which is still fairly new, is product recalls. According to FMI’s 2019 “Power of Produce” report, among the 97% of shoppers who would appreciate updates on major product recalls, email and in-store signage are the preferred contact. Twice as many shoppers simply want in-store signage to inform them of recalls, rather than having the store suggest alternatives. Many shoppers, in particular Millennials, are also interested in learning more about how to safely handle produce at home, especially in regard to safe storage and preparation.

On the same subject, in responses to PG, one survey respondent notes the challenge of “contamination scares of fresh leafy vegetables.” Given this need for greater knowledge and transparency, educating customers can create a bond and build trust.

In August 2019, Progressive Grocer fielded a study to grocery retailers involved in produce operations. A total of 95 retailers responded to the survey.

Of these retailers, 52 percent represent chains with 11 or more stores, while 48 percent operate one to 10 stores. A total of 31 percent are store managers; 27 percent are produce executives; 21 percent of respondents are produce category managers, merchandisers or buyers; and 21 percent are owners, CEOs or presidents.